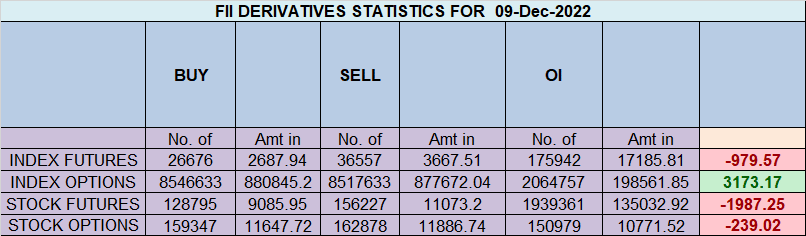

FII sold 9.8 K contract of Index Future worth 1987 cores, Net OI has decreased by 3.4 K contract 6.6 K Long contract were covered by FII and 3.2 K Shorts were added by FII. Net FII Long Short ratio at 1.35 so FII used fall to exit Long and enter short in Index Futures.

Bayer Rule 3: Price goes up when the angle between Mars and Mercury is 161 degrees 21 minutes 18 seconds; Mars must be retrograde. “Bayer Rule 14: VENUS MOVEMENTS IN GEOCENTRIC LONGITUDE USING A UNIT OF 1*9’13”” “RULE NO. 38 MERCURY LATITUDE HELIOCENTRIC Some mighty fine tops and bottoms are produced when Mercury in this motion passes the above mentioned degrees 0, 3*21,6*42, and 7*0’” will come into effect. Aviod carrying overnight position without Hedge today US CPI data so we will see gap up or gapdown on Monday.

Venus Ingress is happening today, Venus is one of the closest planets to Earth, meaning that its Astro Events are more powerful and intense than other planets.

Price is entering the support zone of 18337-18351 formed another outside bar pattern and we have seen pulback of 450-500 points from top healthy correction, As Monday we have important time cycle date so first 15 mins High and low will guide intraday traders.

For Swing Trade Bulls need to move above 18673 for a move towards 18741/18809/18877. Bears will get active below 18544 for a move towards 18475/18406/18337– Almost 2 target done,

For Swing Trade Bulls need to move above 18544 for a move towards 18612/18681/18750. Bears will get active below 18475 for a move towards 18406/18337

MAX Pain is at 18400 PCR at 0.98 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Retailers have bought 151 K CE contracts and 132 K CE contracts were shorted by them on Put Side Retailers bought 458 K PE contracts and 658 K PE shorted contracts were added by them suggesting having BULLISH outlook.

FII bought 170 K CE contracts and 232 K CE were shorted by them, On Put side FII’s bought 159 K PE and 68.4 K PE were shorted by them suggesting they have a turned to BEARISH Bias.

Maximum Call open interest of 32 lakh contracts was seen at 18600 strike, which will act as a crucial resistance level and Maximum PUT open interest of 29 lakh contracts was seen at 18400 strike, which will act as a crucial Support level

Nifty Dec Future Open Interest Volume is at 1.10 Cr with addition of 1.4 Lakh with increase in Cost of Carry suggesting short positions were added today.

Nifty Rollover cost @18392 and Rollover % @75.1 Closed above it.

Till Nifty is below 18588 on closing basis Bears will have upper hand.

FII’s sold 158 cores and DII’s bought 501 cores in cash segment.INR closed at 81.49

#NIFTY50 as per musical octave trading path can be 18058-18595-19132 take the side and ride the move !!

If a trader can take charge of his mind and quell the inner dialogue that creates all sorts of contradictions, and if he can keep his eyes on the time frame of his trading and focus on principles and techniques, he will stand a better chance of becoming a successful, happy, and confident trader.

Positional Traders Trend Change Level is 18745 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18633 will act as a Intraday Trend Change Level.