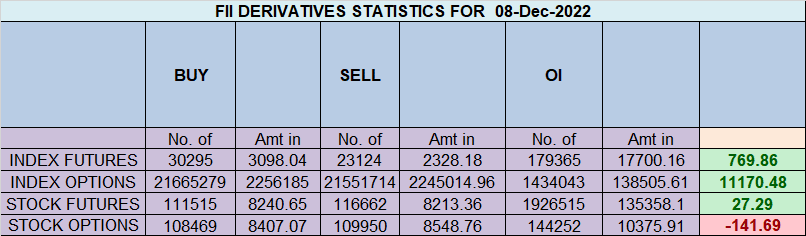

FII sold 12.5 K contract of Index Future worth 1281 cores, Net OI has increased by 1.4 K contract 5.5 K Long contract were covered by FII and 6.9 K Shorts were covered by FII. Net FII Long Short ratio at 1.39 so FII used fall to exit Long and exit short in Index Futures.

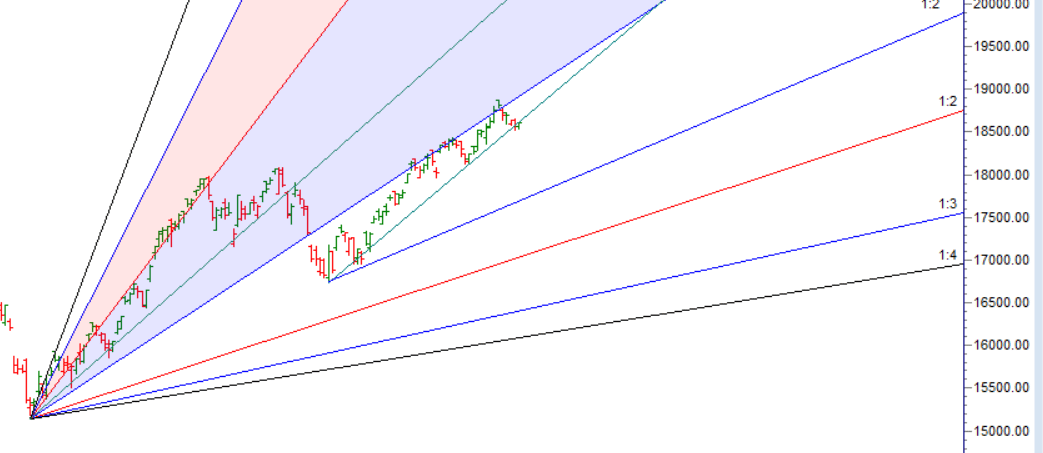

2017 Guj Election we have seen a massive volatialty at opening gap down and quick reovery. Be prepared for it as Gann told History repeat by itslef. Tommrow we also have New Moon first 15 mins HIgh and low will guide for the day.– First 15 mins high broken and trend was on upside.

Bayer Rule 3: Price goes up when the angle between Mars and Mercury is 161 degrees 21 minutes 18 seconds; Mars must be retrograde. “Bayer Rule 14: VENUS MOVEMENTS IN GEOCENTRIC LONGITUDE USING A UNIT OF 1*9’13”” “RULE NO. 38 MERCURY LATITUDE HELIOCENTRIC Some mighty fine tops and bottoms are produced when Mercury in this motion passes the above mentioned degrees 0, 3*21,6*42, and 7*0’” will come into effect. Aviod carrying overnight position without Hedge today US CPI data so we will see gap up or gapdown on Monday.

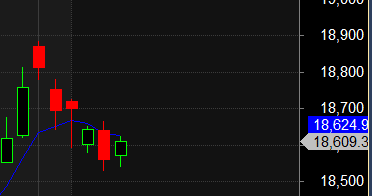

For Swing Trade Bulls need to move above 18673 for a move towards 18741/18809/18877. Bears will get active below 18544 for a move towards 18475/18406/18337

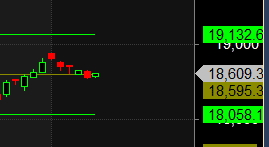

MAX Pain is at 18600 PCR at 0.98 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 22 lakh contracts was seen at 18600 strike, which will act as a crucial resistance level and Maximum PUT open interest of 25 lakh contracts was seen at 18400 strike, which will act as a crucial Support level

Nifty Dec Future Open Interest Volume is at 1.09 Cr with liquidation of 2.14 Lakh with increase in Cost of Carry suggesting short positions were closed today.

Nifty Rollover cost @18392 and Rollover % @75.1 Closed above it.

Till Nifty is below 18624 on closing basis Bears will have upper hand.

FII’s sold 1131 cores and DII’s bought 772 cores in cash segment.INR closed at 81.16

#NIFTY50 as per musical octave trading path can be 18058-18595-19132 take the side and ride the move !!

One of the main reason why technical analysis works is that human nature and emotions remain the same irrespective of era one is in. People were greedy and fearful even a hundred years back as much as they are now.

Positional Traders Trend Change Level is 18755 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18899 will act as a Intraday Trend Change Level.