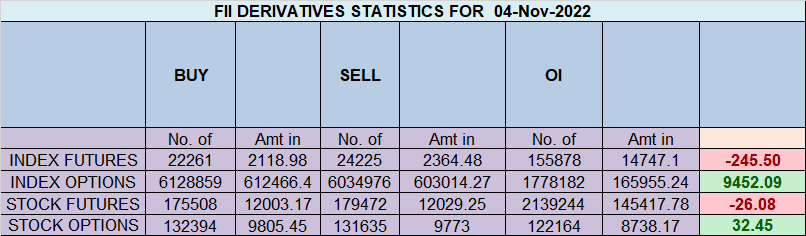

FII sold 1.9 K contract of Index Future worth 245 cores, Net OI has increased by 6 K contract 2 K Long contract were added by FII and 4 K Shorts were added by FII. Net FII Long Short ratio at 1.37 so FII used rise to enter long and enter short in Index Futures.

On 05 Nov Venus Opposition Uranus its Key Dates Imp for Global Market and SUN Opposition North Node suggesting volatlity will continue and best to do intraday trade till 08 Nov when SUn goes in Conjuction with Mercury. Today also with gap down we saw a swift recovery.

For Swing Traders Bulls will get active above 18111 for a move towards 18178/18225. Bears will get active below 18020 for a move towards 17950/17885

Last Night all EU and US Market rallies based on Venus Opposition Uranus and we will see Impact on Nifty with gap up open and should do 18225 in opening. USD INR also saw a good correction is back to 82 which should be bullish for Banks. Till we are Holding 18058 Bulls have Upper hand. We have seen HIghest Weekly close which is Bullish sign

For Swing Traders Bulls will get active above 18227 for a move towards 18294/18361. Bears will get active below 18026 for a move towards 17950/17885

Intraday time for reversal can be at 9:18/10:02/11:48/12:49/1:23/2:33 How to Find and Trade Intraday Reversal Times

MAX Pain is at 18200 PCR at 0.81 PCR below 0.78 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 32 lakh contracts was seen at 18300 strike, which will act as a crucial resistance level and Maximum PUT open interest of 25 lakh contracts was seen at 18000 strike, which will act as a crucial Support level

Nifty Nov Future Open Interest Volume is at 1.17 Cr with addition of 1.8 Lakh with increase in cost of carry suggesting Long positions were added today.

Retailers have bought 874 K CE contracts and 911 K CE contracts were shorted by them on Put Side Retailers bought 707 K PE contracts and 742 K PE shorted contracts were added by them suggesting having BULLISH outlook.

FII bought 220 K CE contracts and 165 K CE were shorted by them, On Put side FII’s bought 146 K PE and 106 K PE were shorted by them suggesting they have a turned to neutral Bias.

NIfty Rollover cost @ 17732 and Rollover is at 70.5 % closed above it.

FII’s bought 1436 cores and DII’s sold 548 cores in cash segment.INR closed at 82.46

#NIFTY50 as per musical octave trading path can be 17551-18058-18595 take the side and ride the move !! 2 days in a row closed above 18058

Profitable Trading : A Trading Strategy With An Edge (positive expectancy) + The Ability To Be Able To Consistently Apply The Strategy

Positional Traders Trend Change Level is 18025 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. Intraday Traders 18133 will act as a Intraday Trend Change Level.