As Discussed in Last Analysis Bank Nifty had important gann and astro date today as discussed in below video. Bank Nifty has also formed double bottom today at 37950 Swing Trade Plan is Bullish above 38333 for a move towards 38528/38723/38971, Bears will get active below 38005 for a move towards 37809/37613/37417. We have Monthly close tommrow Bulls will try to close between 38428-38504. 31 is trading Holiday on account of Ganesh Chaturthi. Market generally reaming Bullish during Ganesh Chaturthi. All Bullish target done For the past 4-5 days, we are having highly volatile days with swings on both sides – but the net result is minimal. Today again we will see gap down of 400-500 points,Swing Trade Plan is Bullish above 39407 for a move towards 39606/39824/40000, Bears will get active below 39208 for a move towards 39009/38910/38611

Intraday time for reversal can be at 09:33/10:31/11:4412:47/1:39/2:25 How to Find and Trade Intraday Reversal Times

Bank Nifty Sep Future Open Interest Volume is at 22.4 lakh with addition of 1.47 Lakh contract , with decrease in Cost of Carry suggesting long positions were closed today.

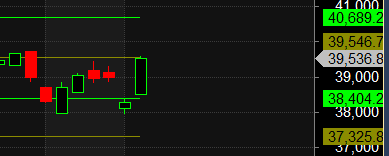

As per Musical Octave 39546 is Pivot Above it rally towards 40689 Below it 38404 .

Maximum Call open interest of 27 lakh contracts was seen at 39500 strike, which will act as a crucial resistance level and Maximum PUT open interest of 24 lakh contracts was seen at 39000 strike, which will act as a crucial Support level

MAX Pain is at 39000 and PCR @0.95 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

In volatile conditions, a trader’s account value gets hurt far less than his psyche. It’s important to make logical, calm decisions in the midst of despair following a mistake or a big loss. Those moments tend to be the very turning points that magnify account value.