Tata Consumer

Intraday Traders can use the below mentioned levels

Buy above 629 Tgt 634, 640 and 646 SL 625

Sell below 621 Tgt 615, 608 and 600 SL 626

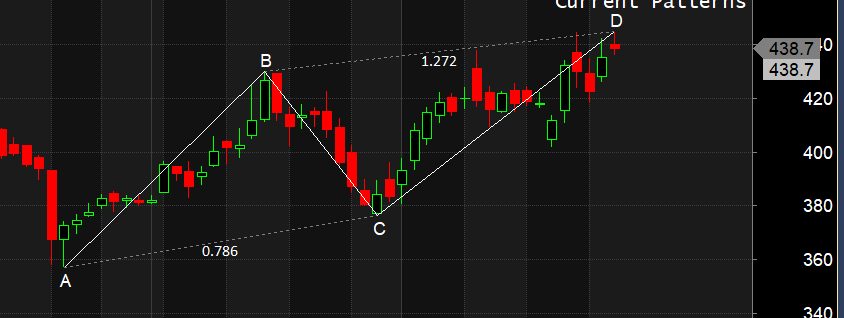

BPCL

Intraday Traders can use the below mentioned levels

Buy above 441 Tgt 445, 449 and 454 SL 438

Sell below 436 Tgt 432, 428 and 424 SL 439

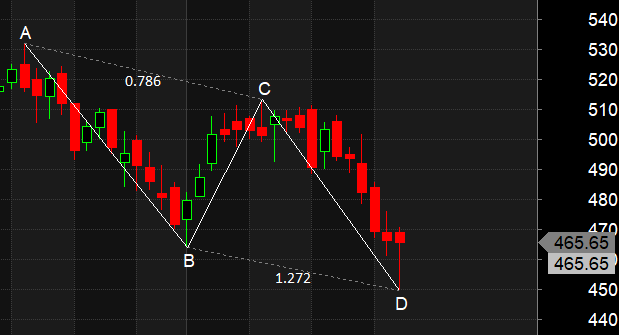

Glenmark

Intraday Traders can use the below mentioned levels

Buy above 466 Tgt 470, 474 and 478 SL 462

Sell below 460 Tgt 456, 452 and 448 SL 464

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is discussed for Dec Month, Intraday Profit of 5.81 Lakh and Positional Profit of 8.97 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if Trading Systems are followed with discipline. Performance “Will differ” from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.