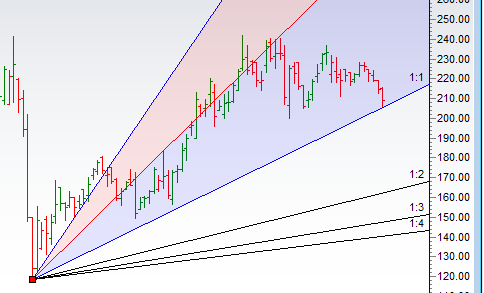

M&M Finance

Positional Traders can use the below mentioned levels

Close below 202 Target 192

Intraday Traders can use the below mentioned levels

Buy above 206 Tgt 209, 212 and 215 SL 204.5

Sell below 202 Tgt 199, 196 and 193 SL 204.5

Infratel

Positional Traders can use the below mentioned levels

Close below 206 Target 196

Intraday Traders can use the below mentioned levels

Buy above 211 Tgt 214, 217 and 220 SL 209

Sell below 206 Tgt 203, 200 and 196 SL 208.5

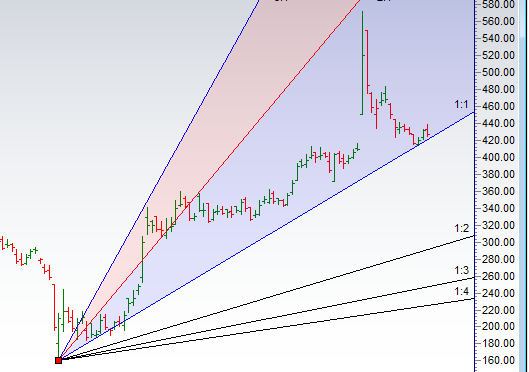

Glenmark

Positional Traders can use the below mentioned levels

Close below 423 Target 400

Intraday Traders can use the below mentioned levels

Buy above 428 Tgt 432, 436 and 440 SL 425

Sell below 423 Tgt 419, 415 and 410 SL 426

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is discussed for June Month, Intraday Profit of 4.46 Lakh and Positional Profit of 6.49 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if Trading Systems are followed with discipline. Performance “Will differ” from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.