- FII’s sold 5.3 K contract of Index Future worth 452 cores ,6.1 K Long contract were liquidated by FII’s and 735 Short contracts were liquidated by FII’s. Net Open Interest decreased by 6.8 K contract, so rise in market was used by FII’s to exit long and exit short in Index futures. FII’s Long to Short Ratio at 1.33,For the August Series FII have net added shorts 106 K Contract till we do not close above 9910 all rallies will get sold into. How to Maintain Control and Discipline in Your Trading

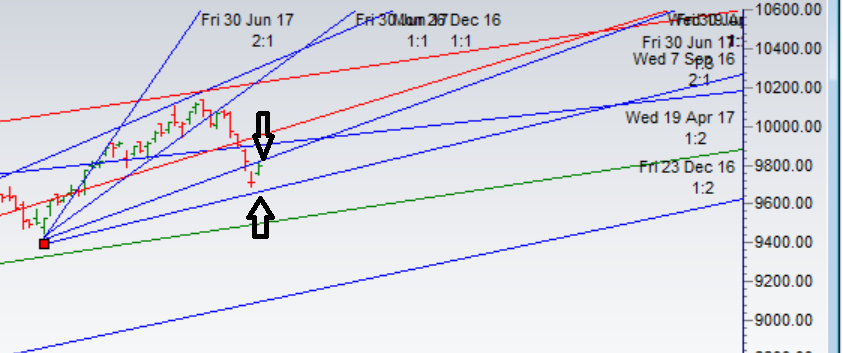

- As discussed in last analysis If 9792 get broken tomorrow we can see fall towards 9700/9642/9619. Bullish above 9820 for a move towards 9870/9960. From 10090 we have seen the fall till 9685 and saw a small pullback towards 9790, Monday close is very crucial as its was at the gann angle resistance,same happened before the fall from 10000, so bulls need to close above 9800 for next move towards 9855/9910/9962. Bearish below 9770 for a move towards 9710/9650/9610. Bank Nifty rallies 400 points from Time Cycle Low

- Nifty August Future Open Interest Volume is at 2.28 core with liquidation of 4.8 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @10036 Closed below it and corrected 300 points.

- Total Future & Option trading volume at 3.68 Lakh core with total contract traded at 0.91 lakh , PCR @0.95

- 10000 CE is having Highest OI at 56 lakh, resistance at 9900 followed by 10000 .9800-10500 CE liquidated 5.8 Lakh in OI so bears covered only partial in range of 9800-10000 CE. FII bought 4.4 K CE longs and 1.7 K shorted CE were covered by them.Retail bought 7.7 K CE contracts and 19.7 K CE were shorted by them.

- 9500 PE OI@55.7 lakhs having the highest OI strong support at 9500 followed by 9600. 9500-10000 PE added 26.8 Lakh in OI so bulls added position in 9500-9700 PE. FII bought 14.6 K PE and 2 K PE were shorted by them. Retail bought 36.9 K PE and 31.4 K PE were shorted by them

- FII’s sold 1638 cores and DII’s bought 1619 cores in cash segment.INR closed at 64.13

- Nifty Futures Trend Deciding level is 9810(For Intraday Traders). NF Trend Changer Level (Positional Traders) 10007. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9800 Tgt 9821,9850 and 9880 (Nifty Spot Levels)

Sell below 9785 Tgt 9760,9740 and 9700 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Sir I also salute ur all valuable thoughts in your blog…. Thanks

thanks a lot for your kind words.. !!

So many thanks to you sir as you are continuing your great job for us.

Pleasure is all mine..

I agree with Mr T srinivas. I thought you are on a brief vacation for week end. We miss your weekly Chopad levels.

S N

thanks its updated for this week..

Sir, Extremely grateful for your update.Whether we make money or not, your presence itself is reassuring. Thank you, sir.

Thanks a lot .. Hope you are doing well..