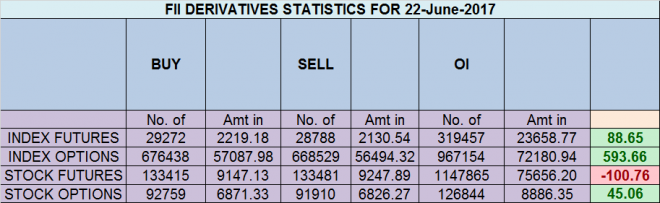

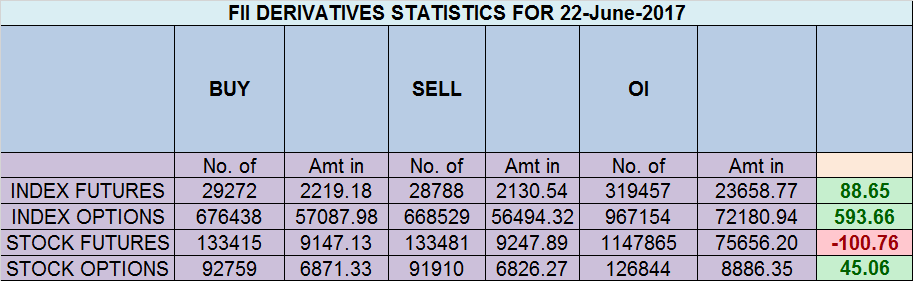

- FII’s bought 484 contract of Index Future worth 88 cores ,370 Long contract were liquidated by FII’s and 854 Short contracts were liquidated by FII’s. Net Open Interest increased by 1.2 K contract, so fall in market was used by FII’s to exit long and exit short in Index futures. FII’s Long to Short Ratio increased to 3. Mistake most amateur traders repeat time to time

- As discussed in last analysis Low made today was 9608 so even though bulls were not able to break the gann angle but they held on to support of 9610 in today’s fall and closed at 9633, Now bulls need a close above 9650 for a quick move towards 9720/9770. Bearish below 9610 for a move towards 9565/9520. Nifty made high of 9698 today unable to make a new life high above 9709 and made low of 9630, so bulls protected 9610 and bears protected 9720 hence trading in neutral zone with high volatility experience during the day.Today is 3 day where we made the failed attempt to close above gann angles, bulls should not delay much else bears will become active and can push nifty lower towards 9500/9400 odd levels. Now bulls need a close above 9650 for a quick move towards 9720/9770. Bearish below 9610 for a move towards 9565/9520. Bank Nifty forms gravestone doji,EOD Analysis

- Nifty June Future Open Interest Volume is at 2.03 core with liquidation of 6.2 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @9435 Closed above it.

- Total Future & Option trading volume at 10 Lakh core with total contract traded at 1.2 lakh , PCR @0.93

- 9700 CE is having Highest OI at 69.5 lakh, resistance at 9700 followed by 9800 .9300-9800 CE added 6 Lakh in OI so bears added some position in 9600-9800 CE . FII bought 3.9 K CE longs and 4.7 K shorted CE were covered by them.Retail sold 46.9 K CE contracts and 35.5 K shorted CE were covered by them.

- 9500 PE OI@55.3 lakhs having the highest OI strong support at 9600 followed by 9500. 9300-9800 PE liquidated 18.7 Lakh in OI so bulls added position in 9300-9400 PE . FII bought 3.3 K PE and 4.1 K PE were shorted by them. Retail sold 70.5 K PE contracts and 65.4 K shorted PE were covered by them.

- FII’s bought 192 cores in Equity and DII’s bought 455 cores in cash segment.INR closed at 64.49

- Nifty Futures Trend Deciding level is 9673 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9629. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9660 Tgt 9680,9700 and 9720 (Nifty Spot Levels)

Sell below 9628 Tgt 9603,9585 and 9550(Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh