KSCL

Positional Traders can use the below mentioned levels

Close above 540 Target 555/566

Intraday Traders can use the below mentioned levels

Buy above 535 Tgt 539, 545 and 551 SL 531

Sell below 530 Tgt 525,520 and 513 SL 533

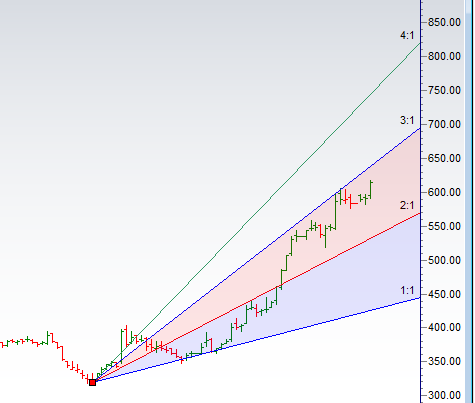

Just Dial

Positional Traders can use the below mentioned levels

Close above 616 Target 631/644

Intraday Traders can use the below mentioned levels

Buy above 620 Tgt 625, 631 and 638 SL 615

Sell below 613 Tgt 608,600 and 588 SL 617

SRF

Positional Traders can use the below mentioned levels

Close above 1632 Target 1686/1741

Intraday Traders can use the below mentioned levels

Buy above 1630 Tgt 1644, 1665 and 1680 SL 1620

Sell below 1605 Tgt 1590,1570 and 1550 SL 1611

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for February Month, Intraday Profit of 4.59 Lakh and Positional Profit of 5.57 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if System are followed with discipline. Also the performance differs from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Bramesh

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

I have prepared my system rules after through backtesting and i am comfortable with my trading rules. I do not expect all traders to follow y rules. Every Trader should find his/her own knack when it comes to trading. Problem with most of traders is 3-5% move can shake of there position as they do not understand how to use leverage in proper way. It comes with lots of experience and hard hitting from market. We have followed our rules we took loos in Granules also in last expiry if you hold position by end of day, If you are conservative trade you can exit if 15 mins it sustain above our position. Bharat Finance in high beta script and you need to be raedy for swing of 3-5% either ways to hold on to it. Tata Elxsi has given loss and we took it. Loss are fertilizers to me to perform better in my next trades. If I can carry JIndal Steel from 121-131 based on my system rules why i need to exception in loss making trades.

Even Roger Federer Winning 18 Grand Slam was not believable. Life is full of surprises embrace it. But stick to your rules with proper risk and money management.

Rgds,

Bramesh

Rgds,

Bramesh