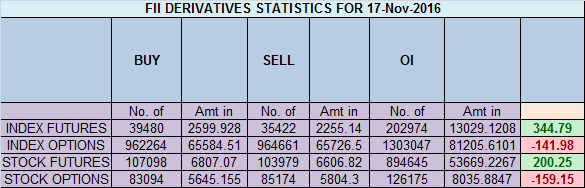

- FII’s bought 4 K contract of Index Future worth 344 cores ,5.5 K Long contract were added by FII’s and 1.4 K short contracts were added by FII’s. Net Open Interest increased by 7 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. How to Keep Your Cool When Trading

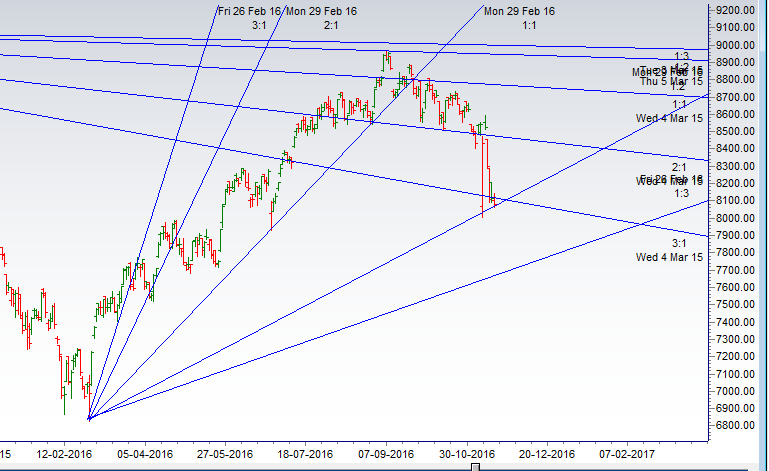

- As discussed in last analysis Next 2 days are very important as bulls need to hold range of 8039-8060 on Weekly closing basis else we can see deeper cut in market towards 7700/7800. Fresh shorts should be done on close below 7972 only for move towards 7800/7750. Low made today was 8060 and near gann angle as shown in below chart, Holding the range of 8039/8060 we can see sharp pullback towards 8210/8360. Fresh shorts should be done only below 7972 for a move towards 7900/7800. Bank Nifty forms DOJI near gann support zone,EOD Analysis

- Nifty Nov Future Open Interest Volume is at 1.87 core with liquidation of 0.99 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8705 made high at 8704 on 01 Nov and correction of 700 points.

- Total Future & Option trading volume was at 6.2 Lakh core with total contract traded at 1.6 lakh , PCR @0.85.

- 8500 CE is having Highest OI at 57.5 lakh, resistance at 8500 followed by 8700 .8000/8700 CE added 25.4 lakh so bears added aggressively 8100/8200 PE .FII sold 1 K CE longs and 11.7 K CE were shorted by them .Retail sold 62.5 K CE contracts and 36.3 K shorted CE were covered by them.

- 8000 PE OI@53.4 lakhs having the highest OI strong support at 8000. 8000-8500 PE liquidated 11 Lakh in OI so bulls ran for cover in 8200/8300 PE. FII bought 8.1 K PE longs and 3.1 K shorted PE were covered by them .Retail sold 8.9 K PE contracts and 4 K PE shorted PE were covered by them.

- FII’s sold 983 cores in Equity and DII’s bought 1144 cores in cash segment.INR closed at 67.83

- Nifty Futures Trend Deciding level is 8118 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8457. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8100 Tgt 8134,8152 and 8188 (Nifty Spot Levels)

Sell below 8060 Tgt 8042,8006 and 7972 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

thanks for share your knowledge and …………….above all today’s charts is more convincing

Hello Brameshji,

Please update Nifty chart, shown chart is Bank nifty.

Kind regards,

Anand Kumar

Thanks its corrected..