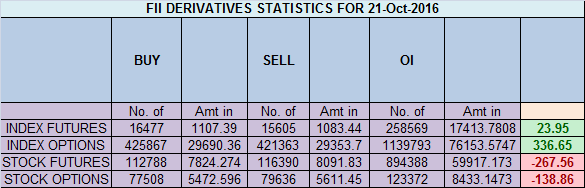

- FII’s bought 0.8 K contract of Index Future worth 23 cores ,0.6 K Long contract were added by FII’s and 0.2 K short contracts were liquidated by FII’s. Net Open Interest increased by 0.3 K contract, so fall in market was used by FII’s to enter long and exit shorts in Index futures. Want to be a Good trader Move out of your comfort zone

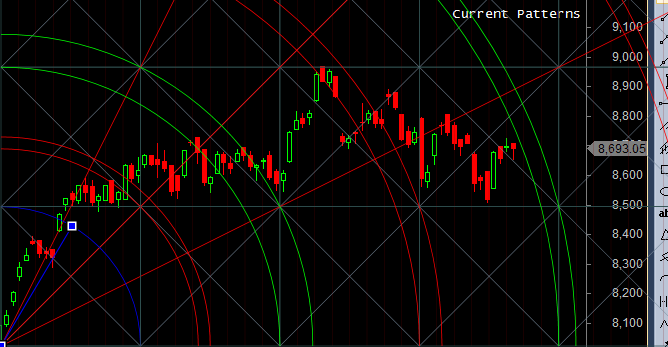

- As discussed last Analysis 8710-8732 is crucial range for bulls as its gann resistance and 8601-8610 is support on downside below which bears will start warming up again. Between the range choppy move continue. High made today was 8709 so bulls were unable to breach the gann resistance zone of 8732, as weekly closing tomorrow bulls would like to close above 8732 and bears below 8656. High made today was 8710 and low made was 8652 so bulls and bears fighting for close above 8732 and bear below 8656 which should be answered in next week as its very imp time cycle is getting over. Bank Nifty Bulls and Bears fighting for 19700,EOD Analysis

- Nifty Oct Future Open Interest Volume is at 1.82 core with liquidation of 3.9 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8777,corrected 250 points from that

- Total Future & Option trading volume was at 3.2 Lakh core with total contract traded at 1.05 lakh , PCR @1.01 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 61.5 lakh, resistance at 9000 .8500/9000 CE added 4.1 lakh so bears added in 8700-8800 range .FII bought 1.9 K CE longs and 4.3 K CE were shorted by them .Retail bought 16.9 K CE contracts and 11.3 K CE were shorted by them.

- 8600 PE OI@55.5 lakhs having the highest OI strong support at 8500. 8500-9000 PE added 4.5 Lakh in OI so bulls added aggressively in 8600-8700 PE. FII bought 7.7 K PE longs and 0.8 K PE were shorted by them .Retail bought 29.4 K PE contracts and 34.2 K PE were shorted by them.

- FII’s sold 272 cores in Equity and DII’s bought 500 cores in cash segment.INR closed at 66.89

- Nifty Futures Trend Deciding level is 8680 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8686 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8710 Tgt 8726,8750 and 8777 (Nifty Spot Levels)

Sell below 8680 Tgt 8660,8630 and 8601 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Sir buy above 8610 or 8710

8710

Sir, what do you mean by gann cycle getting over

Hello Mr. Bramesh, I do not have any words to appreciate you.. I do not have any words to show my gratitude in this work. But I can say one thing that please continue to help us to do proper investment. By following you not only me but many of your followers have rewarded well.. You technical particularly GANN analysis is superb.. Once again appreciate you sir.. If possible can you please help me to learn this GANN analysis by sending any useful documents to my email address : jay.jay8860@gmail.com