- FII’s sold 36.3 K contract of Index Future worth 2329 cores ,35.9 K Long contract were liquidated by FII’s and 0.4 K short contracts were added by FII’s. Net Open Interest decreased by 35.5 K contract, so fall in market was used by FII’s to exit long and enter shorts in Index futures. Ask Yourself following Questions Before Every Trading Day

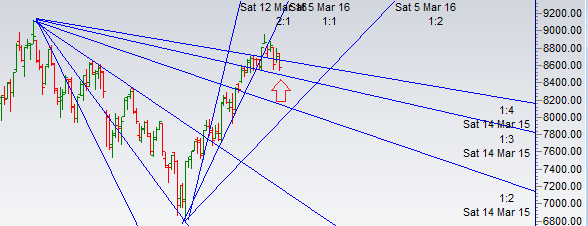

- As discussed last Analysis Bulls will get active above 8756 for a move towards 8800/8840. Bears will be active below 8656 for a move towards 8600/8555. In Between Choppy moves. As soon as 8656 was broken today, Bears were on prowl and nifty made low of 8541 correcting 110 points from 8656 gann level, as we have weekly closing tomorrow and nifty bulls will try hard to hold to 8518-8520 levels and bears will try to close below 8500. Holding 8500-8520 range nifty can again bounce towards 8700/8756/8800. On Downside strong support in the range of 8448-8450. Bank Nifty 1000 points from Gann Resistance of 19811,EOD Analysis

- Nifty Oct Future Open Interest Volume is at 2.12 core with liquidation of 1.7 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8777, closed below it,trading around rollover price suggesting big move round the corner.

- Total Future & Option trading volume was at 6.24 Lakh core with total contract traded at 1.9 lakh , PCR @0.84 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 68 lakh, resistance at 9000 .8500/9000 CE added 10.5 lakh so bears added aggressively in range of 8800-8900 CE .FII sold 6 K CE longs and 11 K shorted CE were covered by them .Retail bought 48.5 K CE contracts and 30.4 K shorted CE were covered by them.

- 8500 PE OI@44.4 lakhs having the highest OI strong support at 8500. 8500-9000 PE saw addition of 6.8 Lakh in OI so bulls added in 8700-8800 CE options.FII bought 40 K PE longs and 2.7 K PE were shorted by them .Retail sold 61.7 K PE contracts and 11.2 K shorted PE were covered by them.

- FII’s sold 911 cores in Equity and DII’s bought 679 cores in cash segment.INR closed at 66.93

- Nifty Futures Trend Deciding level is 8607 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8720 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8600 Tgt 8624,8656 and 8680 (Nifty Spot Levels)

Sell below 8540 Tgt 8515,8480 and 8455 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

As I have mentioned in my last post, Nifty is in bearish mode with downside tgts of 8487/8450. Strong support at 8450. Probably below 8450, next downside tgt is 8325, if broken then it can go down upto 8155. Pull back expected from 8450. Do not hold any shorts at 8450.