- May this Navratri be as bright as ever May this navratri bring joy Health and wealth to you .Happy Navratri Jai Mata Di !! FII’s sold 21.8 K contract of Index Future worth 1379 cores ,21.6 K Long contract were liquidated by FII’s and 0.2 K short contracts were added by FII’s. Net Open Interest decreased by 21.3 K contract, so rise in market was used by FII’s to exit long and enter shorts in Index futures. Where learning ends, beginning of practice happens and that is transformation !!

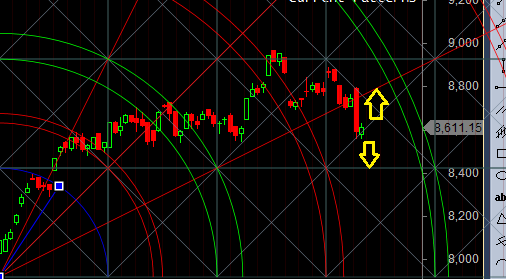

- As discussed last Analysis As we have Weekly Monthly and Quarterly closing bears will like to see Nifty close below 8518 and bears bulls will like a close above 8656. Close below 8518 can see fast move towards 8476/8434. Bullish on close above 8656 only. Nifty made a low of 8555 forming double bottom and also protecting 8518 on Quarterly closing suggesting bulls have not give up yet. Till 8760 is not broken on upside bears have all chance of coming back and correct till 8444 levels, Signal of strength will come once we close above the gann angle line above 8656 and close above 8760 can see nifty moving back towards 8900 zone . Bank Nifty October Series Outlook

- Nifty Oct Future Open Interest Volume is at 2.28 core with liquidation of 9.9 Lakh with decrease in cost of carry suggesting long position were covered today, NF Rollover cost @8777, closed below it.

- Total Future & Option trading volume was at 2.83 Lakh core with total contract traded at 1.8 lakh , PCR @1.04 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 48.8 lakh, resistance at 9000 .8500/9000 CE added 33.5 lakh so bears added aggressively in range of 8800-8900 CE .FII bought 8.9 K CE longs and 21.5 K CE were shorted by them .Retail bought 52.3 K CE contracts and 39.8 K CE were shorted by them.

- 8500 PE OI@35.7 lakhs having the highest OI strong support at 8500. 8500-9000 PE added 5.7 Lakh in OI so bulls added in range of 8400-8500 .FII bought 40.6 K PE longs and 20 K shorted PE were covered by them .Retail bought 45.3 K PE contracts and 49.7 K PE were shorted by them.

- FII’s sold 1028 cores in Equity and DII’s bought 1560 cores in cash segment.INR closed at 66.61

- Nifty Futures Trend Deciding level is 8630 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8668 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8650 Tgt 8683,8705 and 8729 (Nifty Spot Levels)

Sell below 8600 Tgt 8565,8550 and 8520 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

good morning sir, congratulaition for your histrorical articles, previously i saw many tv programme, read many books but did not understand their opinion due to my lack of knowledge. fortunately i find out your article and followed your instruction, i am gainer, sir i am beginer i like attened your institution for better knowledge, hope you shall accept me. please send me course fee. regards m maity