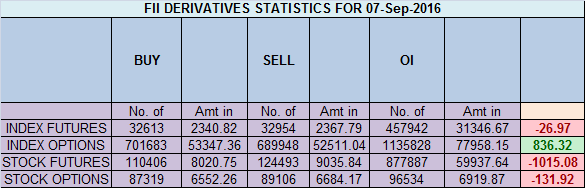

- FII’s sold 0.03 K contract of Index Future worth 26 cores ,2.6 K Long contract were added by FII’s and 3 K short contracts were added by FII’s. Net Open Interest increased by 5.6 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. Solution for Not able to pull the trigger in Trading

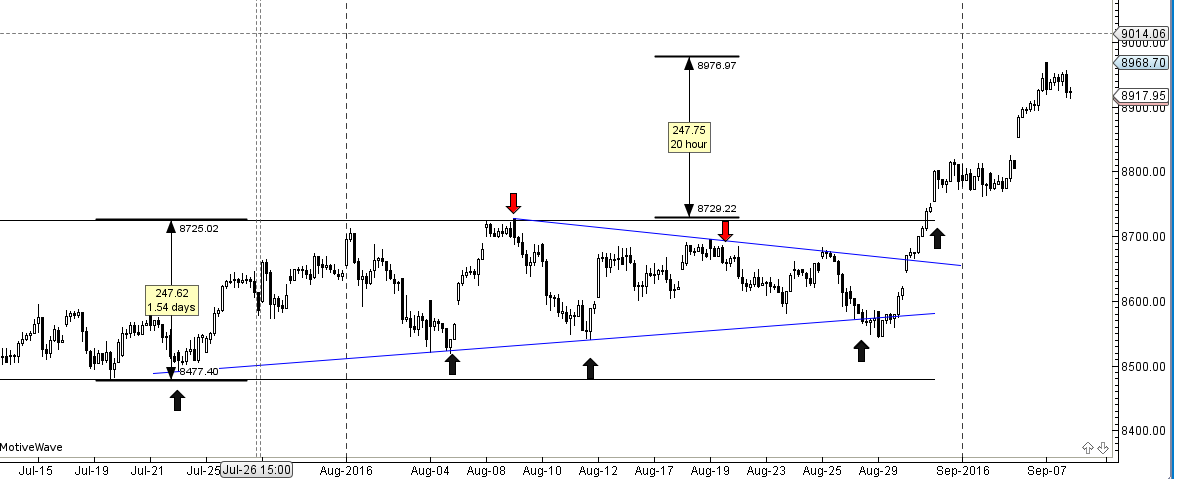

- As discussed last Analysis Now 8951 will become the new 8577. Closing above it Nifty can move all the way towards 9045/9189/9334,Closing below it 8856/8716/8622 are the targets for the September series. Nifty finally did today its breakout target high made today was 8968, But again unable to close above 8951. 8910 will play very crucial role in next 2 trading session as break of that can see quick fall towards 8820 level and holding the same bulls will make one more attempt for a close above 8951 and move towards the sacrosanct level of 9000. Bank Nifty pause in uptrend,EOD Analysis

- Nifty Sep Future Open Interest Volume is at 3.40 core with addition of 1 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @8686, closed above it rallied 250 points.

- Total Future & Option trading volume was at 4.25 Lakh core with total contract traded at 1.02 lakh , PCR @1.03 ,Cash market volume showed a big surge today. Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 55.4 lakh, resistance at 9000 .8500/9000 CE liquidated 12 lakh so finally bears gave up on 8900 .FII bought 14 K CE longs and 4.8 K CE were shorted by them .Retail bought 29.7 K CE contracts and 17.8 K CE were shorted by them.

- 8600 PE OI@60.6 lakhs having the highest OI strong support at 8600. 8300-8800 PE added 3.8 Lakh in OI so bulls making strong base near 8700-8750 zone .FII bought 11.4 K PE longs and 8.9 K PE were shorted by them .Retail bought 35 K PE contracts and 16.6 K PE were shorted by them.

- FII’s bought 854 cores in Equity and DII’s sold 768 cores in cash segment.INR closed at 66.36

- Nifty Futures Trend Deciding level is 8964 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8783 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8935 Tgt 8953,8980 and 9000 (Nifty Spot Levels)

Sell below 8895 Tgt 8877,8850 and 8820 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

sri brahmeshji,u have indicated to your readers that NF 9000 is expectedon 9 th sept.. but nifty went as low as 8858.sirji,we small traders are baffled. pl. give your followers a few logics for reverse behaviour of NF,.

rgrds and thanks,

rallabandi

Now 8951 will become the new 8577. Closing above it Nifty can move all the way towards 9045/9189/9334,Closing below it 8856/8716/8622 are the targets for the September series. 8910 will play very crucial role in next 2 trading session as break of that can see quick fall towards 8820 level and holding the same bulls will make one more attempt for a close above 8951 and move towards the sacrosanct level of 9000.

Bro, your levels are astonishing!! Today we have seen 8952.50 as close!! Our expected close also the 1st target for today!

Hats off to your level sir.

Sir can you please clarify, when should we book profits? Or we should wait for high and higher levels ?

Keep trailing stop levels at appropriate levels.

Do you see crack sign empowering?