Yes Bank

Positional Traders can use the below mentioned levels

Close below 1042 Tgt 1021/1008

Intraday Traders can use the below mentioned levels

Buy above 1058 Tgt 1066,1074 and 1085 SL 1050

Sell below 1042 Tgt 1036,1030 and 1020 SL 1050

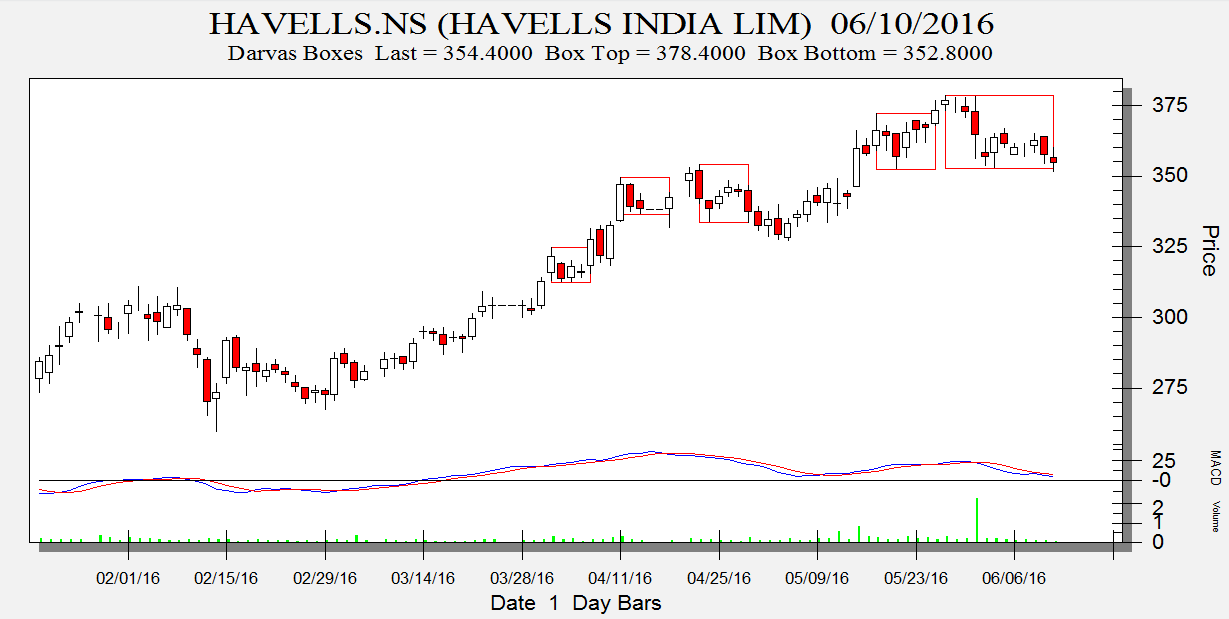

Havells

Positional Traders can use the below mentioned levels

Close below 350 Tgt 343/333

Intraday Traders can use the below mentioned levels

Buy above 355 Tgt 357,359 and 363 SL 352

Sell below 350 Tgt 347,344 and 341 SL 352

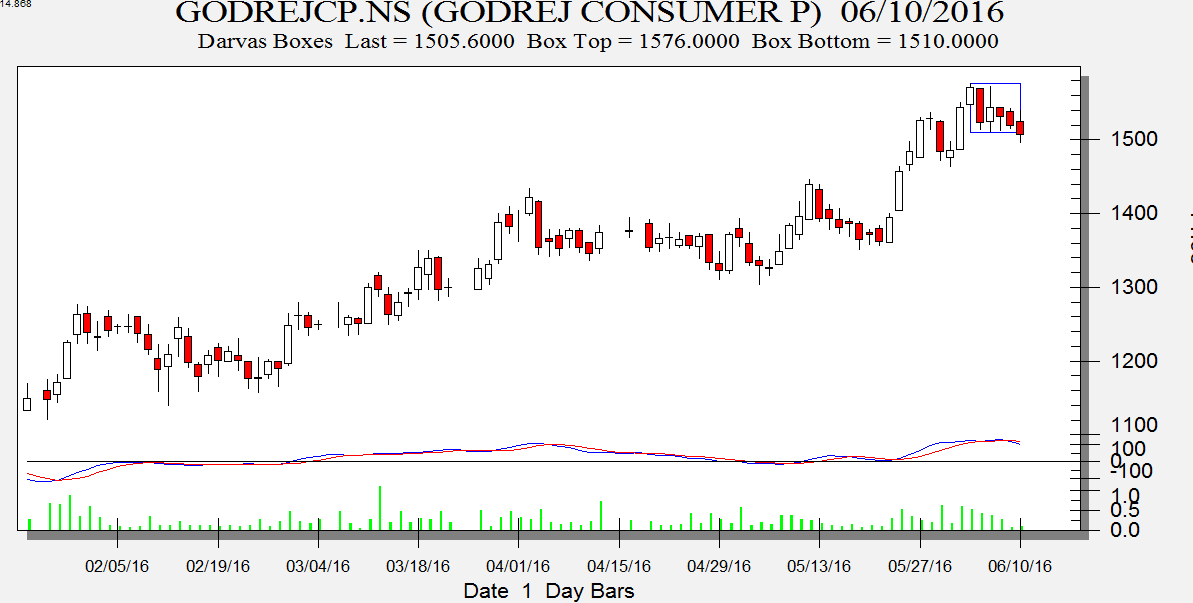

Godrej CP

Positional Traders can use the below mentioned levels

Close below 1500 Tgt 1453

Intraday Traders can use the below mentioned levels

Buy above 1513 Tgt 1530,1545 and 1565 SL 1503

Sell below 1500 Tgt 1486,1470 and 1453 SL 1510

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for April Month, Intraday Profit of 2.31 Lakh and Positional Profit of 3.48 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if System are followed with discipline. Also the performance differs from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

What are the sl on positional calls?

Please read this http://www.brameshtechanalysis.com/2014/08/how-to-trade-intraday-and-positional-calls/

Thank you. If I am unable to take a trade initially and it hits the first target and comes back to trigger point again, is the trigger still valid?

Less trade you do more money u will make..

hello bramesh sir, I seen your daily stocks. im very interested in stock market but I lost some money in stock market so can I trade in ur daily stocks…..

DO paper trading for 3-4 months.. get comfortable with levels make your strict risk and money management rules trade in 20-30 qty till your comfortable and making profit on consistent basis than scale out..