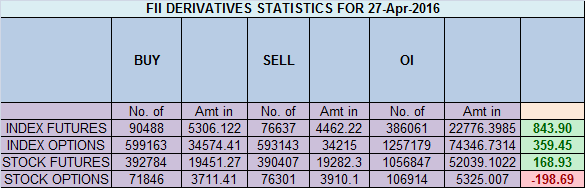

- FII’s bought 13.8 K contract of Index Future worth 843 cores ,26.6 K Long contract were added by FII’s and 12.8 K short contracts were added by FII’s. Net Open Interest increased by 39.4 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. Patience Is A Trader’s Virtue

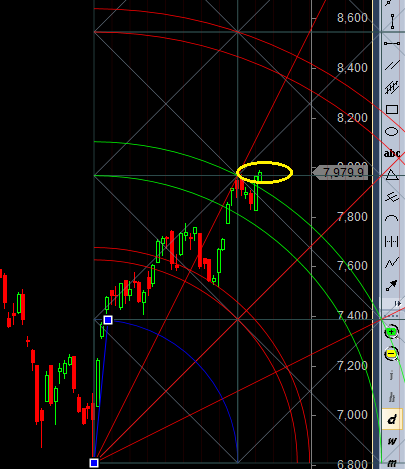

- As discussed in last analysis So we can trade between 7850-7972 range before taking next move. Till close is above gann number of 7850 bulls are in control High made was 7991 and Low 7940 but closed above 7972, Bulls finally close above 7972 also gann resistance line as shown below for next move till 8116/8250. Nifty should give a follow up move in next 2 trading session. Any close below 7972 invalidate the move towards 8116/8250 Will Bank Nifty close above 17067 on Expiry day, EOD Analysis

- Nifty May Future Open Interest Volume is at 1.5 core with addition of 40 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @7955 and Rollover % 60.4.

- Total Future & Option trading volume was at 4.29 Lakh core with total contract traded at 1.3 lakh , PCR @0.96, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 67.1 lakh, resistance at 8000 .7800/8000 CE liquidated 52 lakh so bears liquidated as we closed above 7850 .FII sold 160 CE longs and 5.4 K shorted CE were covered by them .Retail bought 19.5 K CE contracts and 6.6 K CE were shorted by them.

- 7800 PE OI@62.8 lakhs having the highest OI strong support at 7800. 7800-8000 PE added 39 Lakh in OI so strong base near 7800 .FII bought 8.5 K PE longs and 7.7 K PE were shorted by them .Retail bought 11 K PE contracts and 4.2K PE were shorted by them.

- FII’s bought 411 cores in Equity and DII’s sold 295 cores in cash segment.INR closed at 66.44

- Nifty Futures Trend Deciding level is 7978 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7789 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8000 Tgt 8020,8040 and 8071 (Nifty Spot Levels)

Sell below 7950 Tgt 7920,7890 and 7865 (Nifty Spot Levels)

Upper End of Expiry :8048

Lower End of Expiry :7911

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Sir, If NF is below the Trend Deciding Level, how should a trade be taken by Intraday traders.

Samira

Please read this http://www.brameshtechanalysis.com/2013/09/nifty-futures-positional-strategy/

Sir, Thanks for the reply. I have read this article, however I could not find answer to my query regarding Intraday trade to be taken below Trend Deciding Level on a particular day.

Ex. today trend deciding level is 7978, if it is below 7978 how should we trade?

Thanks!

Samira

same concept of positional is applied on intraday

Ur analysis gives us a clear signal how to trade in nifty. Tnx