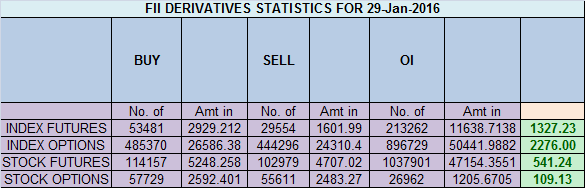

- FII’s bought 23.9 K contract of Index Future worth 1327 cores ,20.4 K Long contract were added by FII’s and 3.4 K short contracts were liquidated by FII’s. Net Open Interest increased by 17 K contract, so rise in market was used by FII’s to enter long and exit shorts in Index futures. Every Success Story Is Also A Story Of Great Failure

- As discussed in Last Analysis We need a close above 7462 for market to reach the next target of ABCD pattern @ 7521. Now range of 7460-7480 should be watched closely as closing above it can see nifty moving in 7550-7575 range where we have strong supply, Nifty opened near gann arc as shown below and started recovering and once move above 7462 rallied towards the target of 7521 and supply zone of 7575. High made was exactly near the supply zone of 7575. Support at 7462 near previous supply zone, Now Bulls should watch 7593/7634 in coming 2 days as these 2 points are strong supply zone once we sustain above 7575 for 1 hour. Bank Nifty bounces from Gann Arc,EOD Analysis

- Nifty February Future Open Interest Volume is at 1.93 core with addition of 5.4 Lakh with decrease in cost of carry suggesting short position were added today, Rollovers comes @67.3% and rollover cost @7419

- Total Future & Option trading volume was at 1.94 Lakh core with total contract traded at 2 lakh , PCR @0.84 .How To Identify Market Tops and Bottom

- 7600 CE OI at 36.4 lakh , wall of resistance @ 7600 .7400/8000 CE added 30 lakh in OI addition was seen by bears as nifty was not able to cross 7575 major addition was seen in 7700/7900 CE .FII bought 44.1 K CE longs and 16.9 K CE were shorted by them .Retail bought 7.3 K CE contracts and 54.2 K CE were shorted by them.

- 7400 PE OI@43.6 lakhs strong base @ 7400. 7300/8000 PE added 21.3 lakh so bulls used to enter lower PE strike prices as finally we closed above 7462. Fight is on for close above 7575 .FII bought 26.7 K PE longs and 12.8 K PE were shorted by them .Retail bought 58.8 K PE contracts and 40.1 K PE were shorted by them.

- FII’s bought 571 cores in Equity and DII’s bought 240 cores in cash segment.INR closed at 67.78

- Nifty Futures Trend Deciding level is 7516 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7484 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer LevelTraders following TC levels have been handsomely rewarded with 100 points gain on first day of series.

Buy above 7575 Tgt 7593,7625 and 7650 (Nifty Spot Levels)

Sell below 7510 Tgt 7480,7460 and 7425(Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

I WISH TO CONSIDER NIFTY HOURLY CHART — STAY ABOVE 7575 IS GREEN SIGNAL TO GO LONG

Nifty has closed at 7563.55 on Friday, so, if market goes above 7575 on Monday can we go long or wait for the day to close above 7575? (positional carry). Also I think the market needs to close above 7575 for 2 consecutive days for the trend to be stronger. Is that right?

yes sir