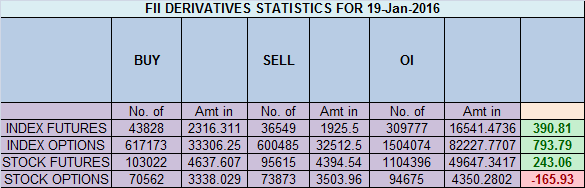

- FII’s bought 7.2 K contract of Index Future worth 391 cores ,2.2 K Long contract were added by FII’s and 4.9 K short contracts were liquidated by FII’s. Net Open Interest decreased by 2.6 K contract, so rise in market was used by FII’s to enter long and exit shorts in Index futures.Keep losses small in order to avoid huge losses

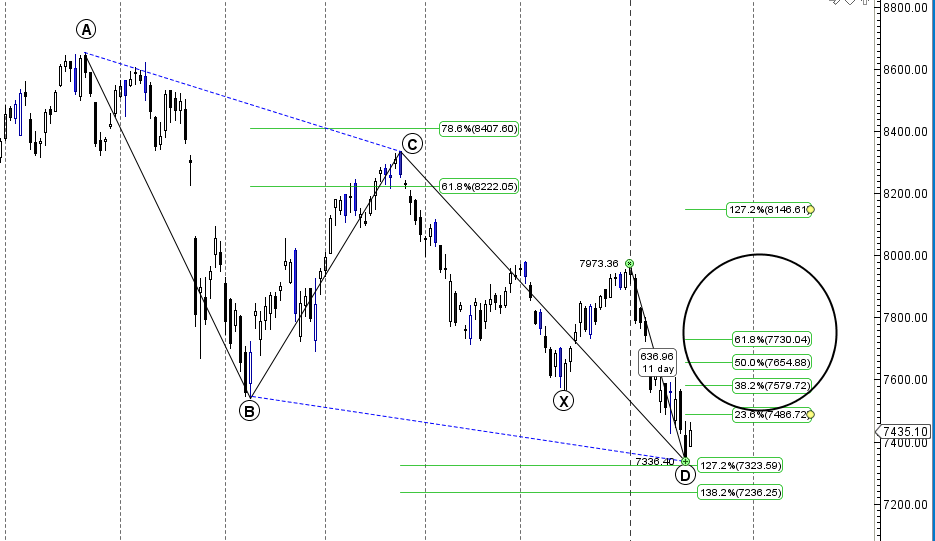

- As discussed in yesterday analysis Nifty has formed a BULLISH ABCD pattern near so if 7323 is held we can see bounceback till 7579/7610/7654 in short term , Short covering rally will be fast and furious. Nifty has corrected 637 so short covering rally cannot be ruled out, our levels are 7323/7300 should be held for the rally to take place. Nifty started with its rally and near the 1 tgt of 7486, now 7400 should be held on closing basis for rally to continue. Bank Nifty Bounces after 2111 correction,EOD Analysis

- Nifty January Future Open Interest Volume is at 2.08 core with liquidation of 4.3 Lakh with decrease in cost of carry suggesting long position were added today . Nifty rollover cost 7930 close below it saw sharp decline

- Total Future & Option trading volume was at 2.74 Lakh core with total contract traded at 1.8 lakh , PCR @0.76.How To Identify Market Tops and Bottom

- 7700 CE OI at 58.6 lakh , wall of resistance @ 7700 .7400/8000 CE added just 0.28 lakh in OI so no major positions were added by bears .FII bought 21.6 K CE longs and 18 K CE were shorted by them .Retail sold 20.2 K CE contracts and 11.1 K CE were shorted by them.

- 7300 PE OI@64.2 lakhs strong base @ 7300. 7300/8000 PE liquidated 9.8 lakh so bulls again used to rise to exit as nifty did not cross yesterday high of 7463.FII bought 22.8 K PE longs and 9.7 K PE were shorted by them .Retail bought 22.7 K PE contracts and 5.4K PE were shorted by them.

- FII’s sold 1203 cores in Equity and DII’s bought 1122 cores in cash segment.INR closed at 67.64

- Nifty Futures Trend Deciding level is 7426 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7480 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7464 Tgt 7486,7520 and 7555 (Nifty Spot Levels)

Sell below 7415 Tgt 7380,7355 and 7330 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Hi Bramesh Ji,

For the stocks you are giving stoploss level. how to trade with Nifty for example buy above 7464. If nifty is trading 1 to 2 mins above 7464 we can take the poistion in Nifty.

What will be the stop loss for this postion. 7450 kind of levels or we need to keep 10 to 20 points.

Please suggest sir.

Thanks

Suresh

Please keep sl of 20 points for trading in nifty

Thanks Bramesh.

Market is a hard teacher you need to adjust to the changing conditions of the market..

Dear sir

How do I follow TC levels of spot levels to trade in future contracts. Please advise me. Sir , also I’m interested in your classes. Please send me course n fee details at

prakruthi.macha@gmail.com

TC level is on NF only for spot we use price action strategy which we cover in our trading course…

Bramesh thank you for your sharing of knowledge and analysis. It helps us a lot while trading.

One request … could you do a medium to long term analysis of nifty? Where are we heading in 1year timespan ..will help in making investment decision.

Thank you in advance

Dear,

I do not know what going to happen next day how will i will be able to know the path of nifty next 1 year. I am a reactive trader not a predictive one.. Take one day at a time..

Rgds,

Bramesh

FII/FPI trading activity on NSE,BSE and MSEI in Capital Market Segment(In Rs. Crores)

Category Date Buy Value Sell Value Net Value

FII/FPI 19-Jan-2016

2695.97 – 3553.67 = -857.7

DII trading activity on NSE,BSE and MSEI in Capital Market Segment(In Rs. Crores)

Category Date Buy Value Sell Value Net Value

DII 19-Jan-2016

2691.27 -1304.44 =1386.83