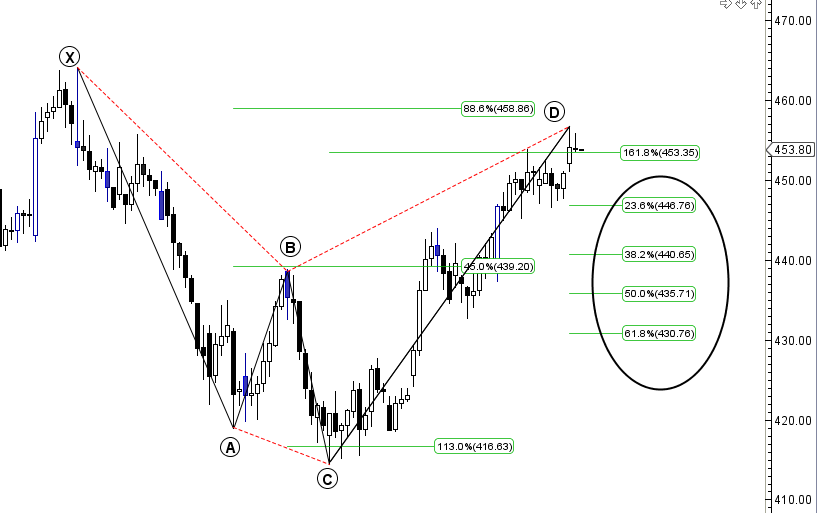

Reliance Infra

Positional/Swing Traders can use the below mentioned levels

Unable to close above 458 Target 446/440

Intraday Traders can use the below mentioned levels

Buy above 455 Tgt 457,462 and 468 SL 452

Sell below 451 Tgt 448.5,443 and 440 SL 453

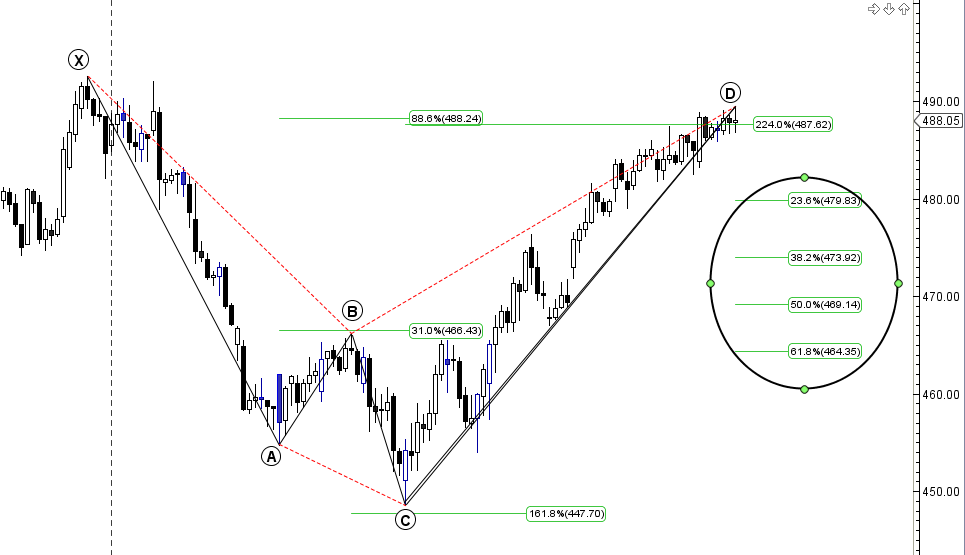

LIC Housing

Positional/Swing Traders can use the below mentioned levels

Unable to close above 493 Short term Target 479/473

Intraday Traders can use the below mentioned levels

Buy above 491 Tgt 493,496 and 500 SL 488.5

Sell below 485 Tgt 481,478 and 474 SL 487

Britania

Positional/Swing Traders can use the below mentioned levels

Unable to close above 2984 Short term Target 2901/2871

Intraday Traders can use the below mentioned levels

Buy above 2950 Tgt 2968,2993 and 3036 SL 2930

Sell below 2920 Tgt 2900,2860 and 2830 SL 2940

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for November Month, Intraday Profit of 4.14 Lakh and Positional Profit of 5.08 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh