- FII’s bought 2.7 K contract of Index Future worth 164 cores ,8.4 K Long contract were added by FII’s and 5.7 K short contracts were added by FII’s. Net Open Interest increased by 14.1 K contract, so today’s rise in market was used by FII’s to enter long and enter shorts in Index futures. Problems Created by Trading Loss

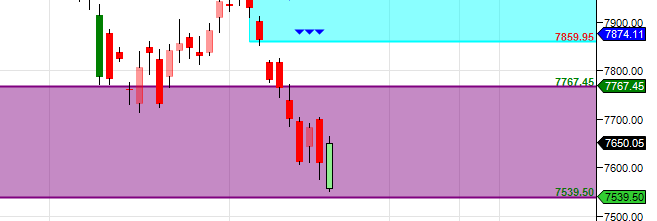

- As discussed yesterday Nifty forming Bullish SHARK pattern its PRZ is near 7550, so price action near 7539/7550 needs to be watched to check the validity of this pattern, Nifty made low of 7551 and rallied almost 100 point from the low,target of SHARK pattern are mentioned in below post, Bullish on close above 7767. Bank Nifty forms bearish engulfing pattern,EOD Analysis

- Nifty December Future Open Interest Volume is at 1.98 core with addition of 3.8 Lakh with increase in CoC suggesting long position were added today. Nifty closing below rollover cost 7896.

- Total Future & Option trading volume was at 1.97 Lakh core with total contract traded at 1.58 lakh , PCR @0.81.

- 8000 CE OI at 65.5 lakh , wall of resistance @ 8000 .7600/8000 CE added 8.4 lakh in OI as bears added position at higher level most of addition was seen in 7800/7900 CE.FII bought 4.4 K CE longs and 10.3 K CE were shorted by them .Retail bought 5.7 K CE contracts and 9.6 K CE were shorted by them.

- 7500 PE OI@ 77.2 lakhs strong base @ 7500. 7600/8000 PE added 3.7 lakh so bulls added on 7600/7700.FII bought 36 K PE longs and 6.4 K PE were by shorted them .Retail bought 25.6 K PE contracts and 36.9 K PE were shorted by them.

- FII’s sold 157 cores in Equity and DII’s bought 386 cores in cash segment.INR closed at 67.1.

- Nifty Futures Trend Deciding level is 7650 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7828 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7664 Tgt 7692,7730 and 7767 (Nifty Spot Levels)

Sell below 7620 Tgt 7600,7580 and 7551 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

CONQUER THE SHARK BY MOVING CLOSELY WITH THE TREND AFTER US FED MTG

Thanks for your valuable views

Sir nifty update please

Ramesh,

Didn’t the shark pattern get invalidated when breaking 7731? I remember having read that in an earlier post of yours.

That was an earlier pattern, this is new pattern we have been discussing from past 5-6 days

Thank you for the clarification. Cheers and Prosperous Trading 🙂

Sir..FII have open positions always so we can not decide to go long or short based on OI data…correct me if I m wrong….thnx

Dear Sir,

It would be helpful if you could provide the TD level in Nifty Spot.

Thanks in advance.

TD is not generated for NS its for NF only..

long or short…confuseing sentence

where is confusion

nifty 7200 possible after fed. if yes then midcap and smallcap can fall upto 30% ???

Hello Sir

Typo –

so today’s rise in market was used by FII’s to enter long and enter shorts in Index futures.

Should have “exit shorts”

No its correct they entered shorts