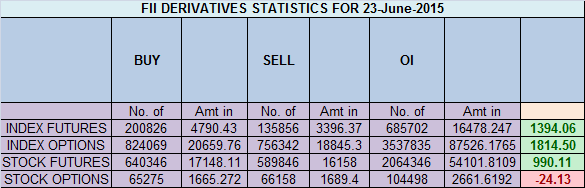

- FII’s bought 64.9 K contract of Index Future worth 1394 cores ,44.6 K Long contract were added off by FII’s and 20.2 K short contracts were squared off by FII’s. Net Open Interest increased by 24.3 K contract, so todays rise was used by FII’s to exit shorts in index futures and add longs. Golden Rules For Traders

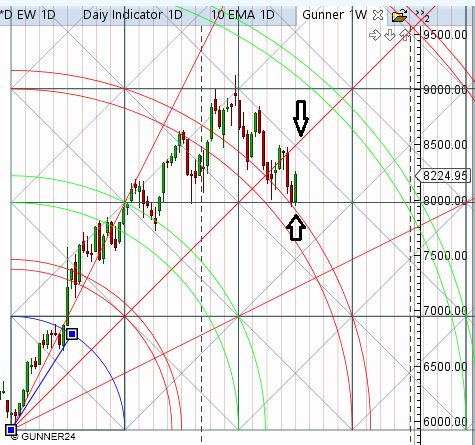

- Nifty continued with its higher high and higher low formation rising 458 points from the low of 7940. Nifty finally formed DOJI at the upper end of AF as shown in below chart.So if 8393 not crossed which is 50% Fibo retracement levels we can see some pullback of 8300/8270 in nifty. Gunner also show we are heading to grey line and green arc so caution advised on longs.High made today is at 3×1 gann angles as shown in hourly charts.

- Nifty June Future Open Interest Volume is at 1.18 core with liquidation of 11 Lakh, with decrease in CoC suggesting longs have exited out of system today.NF Rollover is at 31% with average rate @ 8325.

- Total Future & Option trading volume was at 3.98 core with total contract traded at4.1 lakh. PCR @1.04.

- 8400 CE OI at 48.7 lakh , wall of resistance @ 8400 .8000/8500 CE liquidated 24.2 lakh ,so bears finally gave up and liquidated major positions . FII bought 42.6 K CE longs and 20.8 K shorted CE were covered by them.Retail sold 9K CE contracts. So FII’s bought heavily in CE contact and market keep moving higher.

- 8300 PE OI@ 558.2 lakhs so strong base @ 8300. 8100/8500 PE added 17 lakh so bulls added aggressively today so 8300 is coming up to be strong support . FII bought 20 K PE longs and 15.8 K PE were shorted by them.Retail bought 1.19 lakh PE contracts.So FII’s long in CE and Retailers long in PE, so again its smart money which wins retailers holding short and market rising. 8300 or 8400 should break by FII and make writer of CE and PE run for cover.

- FII’s sold 374 cores in Equity and DII’s bought 404 cores in cash segment.INR closed at 63.5159

- Nifty Futures Trend Deciding level is 8370 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8172 and BNF Trend Deciding Level 18385 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 17850 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8410 Tgt 8435,8450 and 8471 (Nifty Spot Levels)

Sell below 8370 Tgt 8345,8335 and 8308 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

I think next month might break 7900… fii just does the opposite of trend for some time..

In My opinion if CoC decreases two days prior to expiry than every rise should be selloff ,in current expiry scenario too go short around 8410-20 with SL 8433 on closing basis with Tgt 8290-8310 June expiry.

i think 8490 resistance nifty can not fall in this series

nifty is waiting for next series

Sir where do u think this expiry will be ??

upside momentum is so strong that it can take market anywhere .. It is so strong that nifty can move even 3-4% easily if bulls decide to screw bears ..

and this time DII’s moving it …FII’s are loosing mone.. last month and this expiry also .. lol ..

Nifty for the past eight days trending in one direction with out any actual profit booking or correction & up by 458 points. This is not very much surprising since this happened many times in the past also.since fii investing in derivatives the action is steroidal in one side nature. Today June series open interest & CoC down(price moved up) only due to rollover in July series as mentioned above in TA & shrinking of niftys June premium. Here in July series with open interest, CoC, price moved up with a nifty premium around 25 points making to look heavy derivatives long build up in July series with out actual profit booking in June series by fii happened . But always with caution & hedging strategy trading should be seen in the next two trading days of wednesday & thrsday & also the first two days of July series -Friday & Monday these can be very much action packed trading days. Let’s wait & watch was one of the best strategy to learn with patience from Bramesh.

.

Thanks for detailed analysis..

It’s usually either ‘kick on the butts’ or ‘pat on the back’. Not sure what you meant by combining both of them lol

Nifty PE is at 23.23. And, in the last few corrections, nifty always crashes once the PE is around 23.2 to 23.6

But, looking at the strong buy by FII in derivatives, i’m not sure if PE might enter into bubble category of 24 this time.

Don’t know what market has in stock for this time.

Have to wait and watch.

Ya my question is same …..if upside move is capped and nifty entering resistance zone then why such a huge buying from FII …sir plz clear the doubts

Bramesh Sir – I am unable to understand the conflicting signals – on one hand we have FIIs going long in Futures but we still have decreased CoC – indicating overall reduction in longs. Also conflicting signals – FII buying more CEs rather than wrting PEs – seems they too are unsure of the movement. Or they are very sure of quick rise is market that they are ready to add CEs rather than write PEs. Confused, completely confused.

Please consider Futures data from Next month also. Longs are getting reduced in current month but added for next month.

thats why we said Rollover is of 31%

Golden Rule of trading when you are confused about market move stay out !!

Rgds,

Bramesh

Thanks again, wont be surprised to see a test of the 50 dma near 8300 or so and a launch up afterwards into the major resistance zone near 8500.