- FII’s sold 13.8 K contract of Index Future worth 280 cores,3.2 K Long contract were squared off by FII’s and 10.6 K short contracts were added by FII’s. Net Open Interest increased by 7.4 K contract.Losing in Trading? Stick to a Trading Plan & Study Your Mistakes

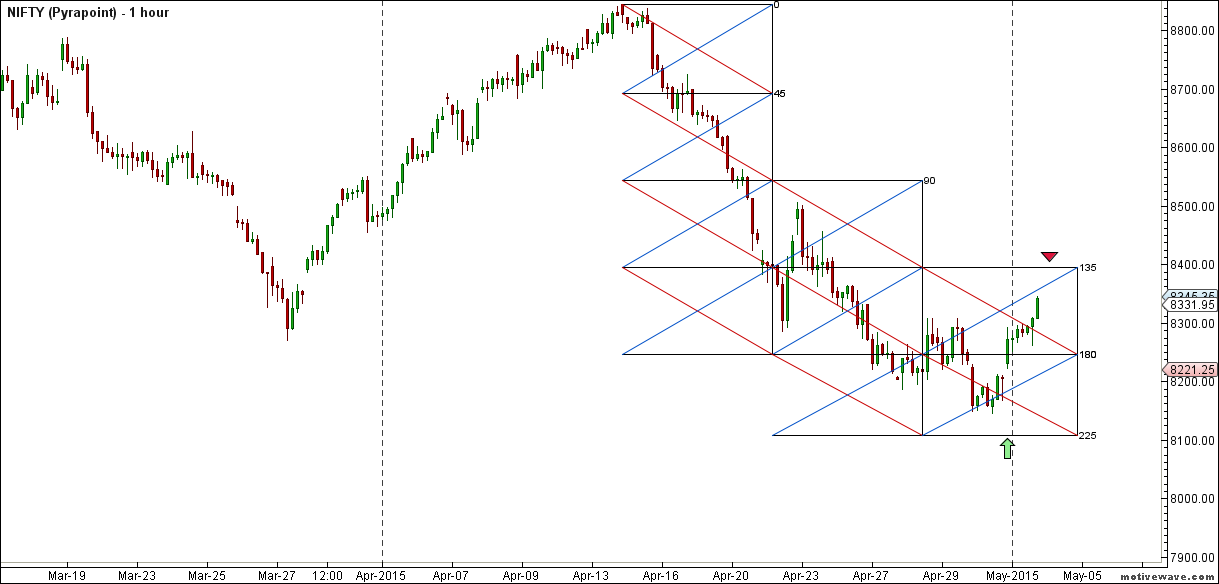

- Nifty after 700 point decline, highest in the current bull market saw a counter trend move today,Nifty opened gap up and closed near day high which look more of short covering as net OI in NF was down, also cash buying by FII’s is just 60 cores. As per Gunner pattern bounce occurred near the green arc and close above 8413 is required for current downtrend to get over. As per pyrapoint also 135 degree line needs to be watched. Gann time analysis as discussed in Weekly analysis worked perfectly with impulsive move.

- Nifty May Future Open Interest Volume is at 1.83 core with liquidation of 5.8 lakhs with cost of carry going negative suggesting long position got closed.

- Total Future & Option trading volume was at 1.69 core with total contract traded at 4.9 lakh. PCR @1. Todays rise was not accompanied by volumes.

- 8600 CE OI at 36.3 lakh , wall of resistance @ 8600 .8300/8600 CE saw addition of 25 lakhs ,so bears added fresh position and no liquidation was seen in today’s rise. FII bought 37.3 K CE longs and 78.5 K CE were shorted by them.

- 8100 PE OI@ 35.3 lakhs so strong base @ 8100. 8200/8400 PE added 15 lakh so bulls are back but need more addition for downtrend to get over. FII bought 170 K PE longs and 17.3 K PE were shorted by them.

- FII’s bought 60 cores in Equity and DII’s bought 146 cores in cash segment.INR closed at 63.43.

- Nifty Futures Trend Deciding level is 8326(For Intraday Traders). NF Trend Changer Level (Positional Traders) 8280 and BNF Trend Deciding Level 18592 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18517 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8346 Tgt 8378,8400 and 8425 (Nifty Spot Levels)

Sell below 8298 Tgt 8260,8240 and 8220(Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Bramesh Ji,

are you sure … this data is correct …

[FII’s sold 13.8 K contract of Index Future worth 197 cores,34.3 K Long contract were added by FII’s and 43.3 K short contracts were added by FII’s. Net Open Interest increased by 77.7 K ]

because your image showing index future sell worth 280.49…..

Its updated.. Thanks !!

Sir do provide some technical update on major commodities like gold and silver

Thanks..

Does it mean that Nifty is not in grip of bears and we can see 7700 level soon before 15th??

NF trend changer level wrong. plz correct. 8380 is correct i think.

No its correct.

Ok thanks sir. Sry for wrong query.

No Probs..