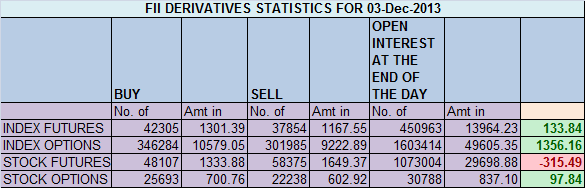

- FIIs bought 4451 contracts of Index Future worth 134 cores (11318 Longs were added and 6867 shorts were added ) with net Open Interest increasing by 18185 contracts, so FII’s added both long and short in Index futures suggesting volatile move ahead in next 2 days.

- Nifty after forming double bottom at 5972 rallied till 6228 and closed above 6200 for second day. Nifty is still trading in the range of 6000-6220. Close above it and sustain for 2 days will signify a breakout else we can see again a pullback in market. Except a huge swings with volatile move today as traders will get prepared for Exit polls outcome. If exit poll says BJP leading in all 4 will make sure Nifty will cross 6228 and move around 6350, Any surprise will lead to a downside till 6000. Traders are getting complacent on upside which should always be treated with caution.

- Nifty Future December Open Interest Volume is at 1.87 cores with addition of 3 lakhs in Open Interest,with increase in cost of carry signalling long addition

- Total Future & Option trading volume at 78.5 lakh with total contract traded at 1.5 lakh.PCR (Put to Call Ratio) at 1.02.The VIX shot up today by 5%,indicating increasing fear amongst option writers and has the effect of making options more expensive.Thats the reason why most of CALLS were trading in green,and the premium are absurd, golden opportunity for option writers.

- 6500 Nifty CE is having highest OI at 48.8 lakhs lot of speculation in OTM call ,6300 CE added 1.5 lakhs Will remain initial top of market. FII’s bought 26.6 K in Call mostly 6300 and 6500 CE and 15.9 K CE were shorted mostly 6100 and 6200.5800-6500 CE added 5 Lakh in OI

- 6000 PE is having highest OI at 55.3 lakhs suggesting strong support at 6000.6100 and 6200 PE added 12.1 lakh in OI suggesting buying happening and traders are hedging there longs. 6100 is emerging support for market.FII’s bought 57.4 K in PE mostly 5900 and 5800 PE and 23.8 K PE were shorted.5800-6500 PE added 22 Lakh in OI. My sincerer advise to traders in do not buy options next few days as premium erosion will be very very fast not giving time to exit also.

- FIIs bought 516 cores in Equity ,and DII sold 671 cores in cash segment.INR closed at 62.3.

- Nifty Futures Trend Deciding level is 6248 For Intraday Traders). NF Trend Changer Level (Positional Traders) 6218 and BNF Trend Changer Level (Positional Traders) 11247 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6206 Tgt 6221 ,6240 and 6290 (Nifty Spot Levels)

Sell below 6187 Tgt 6172,6155 and 6118 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/