- FIIs sold 29103 contracts of Index Future (Entered fresh shorts in 26820 contracts and booked profit in 2283 Longs) worth 772 cores with net Open Interest increasing by 24537 contracts. So as per data analysis, FII’s are still entering in fresh shorts in NF and BNF,The rally we saw today was backed by short covering and fresh shorts were entered at higher levels. How to deal with Trading Loss

- Nifty finally gave the much awaited relief rally in yesterday trading session,still Nifty is trading below the Fibo Fan line as shown in below chart.Nifty has retraced 50% of recent fall,suggesting pause in short term downtrend. It gets confirm with a weekly close above 5426. Bears will try to close nifty below 5338 for downtrend to continue. Nifty is trading in large range of 150+ points in last 2 trading session. so expect some range contraction today.

- Nifty Future Aug Open Interest Volume is at 2.35 cores with liquidation of 6.8 lakhs in Open Interest, so of 34 lakh which got added today only 6 lakh got unwounded suggesting traders are still short in market, any trade above 5426 will further fuel the short covering rally.

- Total Future & Option trading volume at 2.25 lakh with total contract traded at 4.6 lakh , PCR (Put to Call Ratio) at 0.99. VIX closed at 27.68 and was up by 30% in August series.VIX has formed a bearish candlestick pattern so if this pattern comes into effect nifty trading range will contract substantially. Last 5 days were heaven for intraday traders and traders trading based on Quadrant System would have made 300+ points 🙂

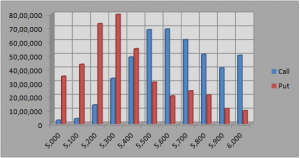

- 5500 Nifty CE is having highest OI at 68.4 lakhs with addition of 13.9 lakhs in OI. 5600 CE added 7 lakh in OI will be resistance in short term.As per Option data OI analysis FII entered long in 6.4K call options mostly in 5500 CE and marginal shorting in Call. So basically FII are hedging there shorts with negative bias. 5400-5700 CE liquidated 1.4 lakh in OI.

- 5300 PE OI at 79lakh remain the highest OI, with addition of 12.5 lakh in OI, remains the firm support for time being. 5400 PE added 6.2 lakh in OI.As per Options Data analysis, FII has entered long in 32.7 K ITM PE and also entered 38.5K in Put writing , so basically FII’s are seeing a reduction in VIX and shorting OTM PE’s as premium will come down fast as we are nearing expiry .5300-5700 PE added 11 lakh in OI.

- FIIs sold in Equity in tune of 1277cores ,and DII bought 389 cores in cash segment ,INR closed at 64.3 new life time low.

- Nifty Futures Trend Deciding level is 5426(For Intraday Traders).Nifty Trend Changer Level 5658 and Bank Nifty Trend Changer level 9986 .Trading trading based on TC levels in NF had made more than 450+ point and BNF made more than 1300 points :).

Buy above 5428 Tgt 5440,5475 and 5491 (Nifty Spot Levels)

Sell below 5402 Tgt 5389,5361and 5345(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

hi Bramesh,

i have started following ur blog and i am really thankful to you for the derivative analysis which you post every night.

one question though, i was check the site of SEBI. there FII derivative data is different from what you post on the blog. i wanted to know how you compile the data.

regards

kamaldeep

Dear Kamaldeep,

These are covered as part of my trading course.

Rgds,

Bramesh