- FIIs sold 24453 Index Future worth 706 cores with net Open Interest increasing by 5757 contracts.FII have again started shorting Nifty and Bank Nifty Futures.

- Nifty gave a move as discussed but with a gap down took support near falling trendline and in process broke 5800 odd levels. 5750 needs to be watched closely any break below it can take nifty sub 5700 odd levels.

- Nifty Future July Open Interest Volume is at 1.47 cores with liquidation of 3.3 lakhs in Open Interest, so profit booking continued today.

- Total Future & Option trading volume at 1.11 lakh with total contract traded at 2.5 lakh , PCR (Put to Call Ratio) at 0.91, VIX trading at 18.91

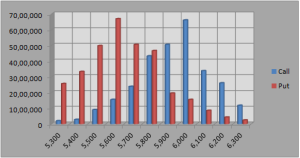

- 6000 Nifty CE is having highest OI at 66.1 lakhs with addition of 4 lakhs in OI 22 lakhs in past 3 days, 6000 remains the ceiling for time being. 5900 CE added 8 lakh in OI suggesting 5900 will remain the next immediate resistance. 5700-6200 CE added 19.6 lakh in OI.

- 5600 PE OI at 66 lakh remain the highest OI ,5800 PE is having OI of 46.6 lakh liquidated 8 lakh,as nifty broke 5800, 5500-6000 CE liquidated 6.3 lakh in OI.

- FIIs sold in Equity in tune of 705 cores ,and DII bought 252 cores in cash segment ,INR closed at 60.05 again approaching the life highs.

- Nifty Futures Trend Deciding level is 5758(For Intraday Traders).Nifty Trend Changer Level 5800 and Bank Nifty Trend Changer level 11511.

Buy above 5782 Tgt 5803,5836and 5851(Nifty Spot Levels)

Sell below 5748 Tgt 5720,5699 and 5666(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863