- FIIs bought 12509 Contracts of Index Future ,worth 384 cores with net Open Interest increasing by 27881 contracts, so FII have started shorting in Index futures mainly Nifty and Bank Nifty as OI is rising significantly and they took longs in CNX IT,DJIA and S&P 500 indices. Commodity Market Risk

- Nifty made a low of 6102 in volatile session today, traders who are reading analysis would have made made good profit as Nifty turned back from trend deciding level of 6190 as discussed yesterday.Tomorrow market closing is very important as nifty is near the bottom of up trending channel and break of 6100 on closing basis can evaporate the bullish sentiment. 6120 still holds the key for short term bullish momentum, today was the first day we closed below that level.

- Nifty Future May Open Interest Volume is at 2.59 cores with addition of 1.94 lakh in Open Interest with decrease in Cost of Carry of Nifty Future to showing traders are entering long position .

- Total Future & Option trading volume at 1.64 lakh with total contract traded at 2.3 lakh , PCR (Put to Call Ratio) at 1.01.Cash market volume were still less showing no panic in delivery based traders.VIX trading at 17.81

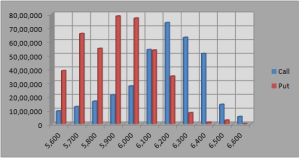

- 6200 Nifty CE is having highest OI at 73 lakhs with addition of 2.2 lakhs in OI and remains the wall of resistance ,6100 remains the support level and OI at 53 lakhs .5700-6300 CE added 2.3 Lakhs in OI.

- 5900 Put Option is having highest Open Interest of 78 lakhs and 6000 PE is having OI of 76 lakhs is the new emerging support for nifty ,6100 PE liquidated 2.5 lakhs and net OI at 53.6 lakhs,suggesting put writers were caught on wrong foot today, 6100 base is still not strong and price action for tomorrow will give more clarity .5700-6300 CE liquidated 16 Lakhs in OI.

- FIIs bought in Equity in tune of 679 cores,and DII sold 867 cores in cash segment ,INR closed at 6 month low 55.41 Live INR Chart for market hours and currency traders

- Nifty Futures Trend Deciding level is 6140 (For Intraday Traders).Nifty Trend Changer Level 6042 and Bank Nifty Trend Changer level 12703.

Buy above 6132 Tgt 6150,6162 and 6180(Nifty Spot Levels)

Sell below 6100 Tgt 6084,6065 and 6048(Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

We do discussion in Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Better if u share ur so called analysis. Knowledge gets bigger n wider if it is knowledge n shared not with kept in dark room of analysis.

Puneet, The “So called analysis” is shared in my trading course. If anyone has done serious study of some subject in any field, it cannot be summarized in a post, it requires a detailed explanation.

Saying “share your so called analysis” with superlatives is easy thing but doing analysis is difficult task. So next time you write comment make sure you request for something not order as if you are the BOSS.

Rgds,

Bramesh

with increase in OI in Nifty Future along with decrease in coc , how u r coming to conclusion that traders are entering in long side of trade? would appreciate if u will respond with details of mine both the question. Thanks

How u r saying fii are started shorting index futures when the net figure is more on buying side with increase in open interest?

These data analysis shared in above post is as per my FII Data sheet i have developed in past 4 years.

Rgds,

Bramesh