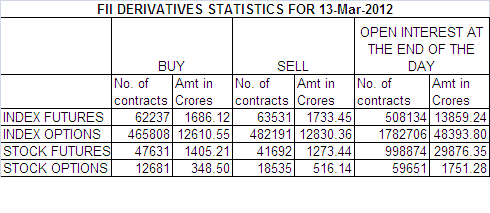

Below is my Interpretation of FII OI data Sheet for 13-Mar-12.

1. FII sold 1294 Contracts of NF worth 47 cores OI also decreasing by 9700 contracts.

2. As Nifty Futures was up by 80 points and OI has decreased by 9700 contracts means profit booking on longs was done by institutions.

3. Today we Opened with a Gap of 30 Points and the gap never got sold off ie. no gap filling process took place, which basically means lower levels serious buying is emerging. Shorter who got trapped need to closes there shorts at higher levels

4. Golden Crossover of 50/200 DMA took place which is considered a Bullish signal and trend reversal sign.

But always remember the SMA should be allinged in increasing order ie.

20 SMA>50SMA>100 SMA>200 SMA for long term uptrend.

If we have a close look at Nifty chart 100 SMA is still lower than 200 SMA so Golden Cross will not have bullish significance till 100 SMA moves above 200 SMA

Another Aspect which needs to be taken into consideration is do not go by these signals blindly I have pointed in above chart we had Death Crossover ir 50 SMA is crossing 200 SMA on downside but Nifty kept on rallying before an eventual fall So these are long term signals and should not be blindly traded on.

5. After 10 trading sessions Nifty finally conquered the 20 SMA making it buy on dips till it closes above 5400. Still lot of ground needs to be covered by Bulls by making Nifty close above 5460. Will the Railway Budget provide the much required trigger for tomorrow.

6. Nifty March OI has decreased by 1 lakh .Total OI stands at 2.50 cores contracts.Fresh longs were added in Nifty Futures.

7.Total F&O turnover was 91.5 Lakh Cores with total contract traded at 268373 . Concern is volumes on a 80 points rise are quiet less and which can be sold off quiet easily on downside in terms of any surprises.

8. In equity FII bought 872 cores DII sold 433 cores. We are rising with Tide and njoy the longs till the music lasts.

9. FII trading in Options do Provide some interesting insights let me share it across. FII net OI got decreased by 53K yesterday when Nifty opened gap up and went down. Today we had seen an addition of 1 lakh in OI which means more gains can be added to this current rally.

10. 5600 CE is having highest OI of 58 Lakhs seems with fresh addition of 6 Lakh contracts 5200 PE having highest OI of 82 lakhs with addition of 7lakhs. 5200 seems to be a firm base.

11. 5400 looks like laxman rekha for bulls which is crossed today and we have an addition of 9 lakhs in 5400 PE. 5500 CE also saw a small unwinding of 61k contracts.

12. 5900 CE saw a surprise addition of 1 lakhs in OI with premium being 8 rs so smart money has enterted into 5900 CE

12. Nifty Futures Trend Deciding level is 5455 at Trend Changer at 5375 NF (Above this Level Bulls will rule Nifty).

Buy above 5440 Tgt 5455,5483 and 5520

Sell below 5392 Tgt 5371,5354 and 5322 (Nifty Spot Levels)

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl

To Get Real Time update on Nifty during market hours you can LIKE the page.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

THANKS A LOT SIR.

golden cross: when 50 sma cuts 200 sma upside it is considered as long term bull signal

death cross : when 50 sma cuts 200 sma downside it is considered as long term bear signal

As sir has told rightly it should be validated with 20,50,100,200 sma all rising 20 > 50 > 100 > 200 for bull run.

20<50<100<200 for a bear market.

Thanks a lot Sir for clarifying the doubt..

Rgds,

Bramesh

SIR YOU ARE ALWAYS EXCELET WILL YOU PLEASE SIMPLYFY GOLDEN CROSS MORE .THANKS & YOUR YAHOO ID IF ANY FOR CONNECTING TO YAHOO MEESSENGER FOR QUICK GUIDENCE FROM YOU PLEASE.

Dear Sir,

Hope your doubt are clarified, You can Join us on facebook during market hours

Click LIKE and Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Rgds,

Bramesh