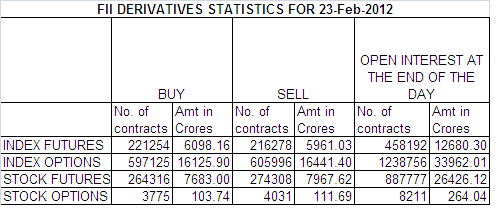

Below is my Interpretation of FII OI data Sheet for 23-Feb-12.

1. FII bought 4976 Contracts of NF worth 137.31 cores OI also decreasing by 343895 contracts with NF ending the month with 325 points gain

2. As Nifty Futures was down by 30 points and OI has decreased by whopping 343895 contracts means FII did profit booking on longs.

3. Nifty march future closed at 5539 a premium of whopping 56 points, Such High premium cannot be sustained for long time and it signals correction is inevitable to get the premium back to normal levels.

4. Nifty Feb OI has decreased by massive 36 lakh .Total OI stands at 1.2 cores contracts.March Series OI has increased by 34 lakhs with total OI standing at 2.3 cores means Feb contracts got rollovered to march. Now are these shorts or longs? Someone who rollovered his shorts got a whopping 60 points premium which does make a good risk to reward ratio for shorters

5. As 35 Lakhs got rollovered today when Nifty March Future made a low of 5503 and High of 5591 implying 5503 be an important support levels for March Series.Basically 1.8 Cores NF contracts got added in 5664-5539. So basically NF trading below this range will lead to more weakness.

7.Total F&O turnover was 2.58 Lakh cores highest FnO turnover in past 5 months.

8. In equity FII bought 104.55 cores DII sold 640 cores. FII has bought massive 16147 cores in Feb series only

9. 5500 CE March is having highest OI of 26 Lakhs 5300 PE is having the highest OI 46 Lakhs. With NF closing negative still PE lost premium because of 59 points premium.

10. Volatility index collapsed today by 10%. I have not seen in recent past collapsing 10% with nifty closing in red. I would be caution on Long side in Nifty due to high premium.

11. FII SAR 5534 NF March((For Positional Traders) and VWAP at 5391 NF (Below this Level Bears will attack Nifty).

12. Today we had a quick points on intrady based on SAR levels and Morning analysis for Feb expiry proved correct with Nifty closing at lows of the day.

Buy above 5494 Tgt 5507,5527,5562

Sell below 5460 Tgt 5447,5427 and 5400 Intra day Players can use the Levels.

All levels mentioned are SPOT levels.

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl

We do discussion is Live market to update Nifty levels If you are interested you can LIKE the page to get Real Time Updates.

Follow on Facebook during Market Hours: http://www.facebook.com/pages/Brameshs-Tech/140117182685863

Bramesh sir, i m one of yr fans of fii oi analysis.Sir i m watching yr FII SAR level from few days..it is working beautifully.Plz tell how much points sl needed if i enter a trade on it??thx

Dear Anujji,

Please keep a Sl of 20 Points for your trade as per SAR level.

Rgds,

Bramesh

WILL THIS BE SAFE TO BUY PUT AT THIS LEVELS?

Dear Sir,

I do not advise trading in Options.

Rgds,

Bramesh

@ Tushar:

How you are watching candelstick patterns.. Can you pls elaborate here..

SIR NIFTY MADE LOW OF 5428 HAD ALL GAP FILLED? AND WHAT IS INPORTANCE OF THIS LEVEL.THANKS

Dear Sir,

One Gap gets filled Nifty will move again towards its orginal trend ie on Upside. Longs can be taken with a SL of 5406 NS

Rgds,

Bramesh

In point No. 4 you have mentioned someone who rollovered shorts paid whooping 60 pts premium,

Those who have long if they rollovered he should pay a premium, actually the seller will get benefit of premium

Is that right

Thanks a lot for pointing out the mistake.

The mistake has been corrected.

Rgds,

Bramesh

Nifty is in overbought condition.And candlestick pattern shos nifty can correct upto 5380 spot. So dont go long till 5380 spot. It is very dangerous.FIIS shorted nifty futures in huge quantity.

Excellent analysis as usual– like to share few observations as you ve rightly spotted in todays analysis–

1 — NF march trading @ huge premium > 50 points — since long time at least last 2 weeks — inspite of consecutive red candles — last 2 days 2– sudden drop in IV inspit of last hr weird move – a sudden spike from 5480 — 5540 within 20 min– and then sudden collapse — back to 5480 – NF (feb)– realy no explanation for such haphazard move – ? expiry blues – and surprisingly – -this is accompanied by sudden drop in IV–as you ve rightly mentioned — ???

3– addition @ 5300 PE , 5400 PE in late trades and 5100 , 5200 PE — also — highest OI build up @ 5200 PE — realy not much addition for call sides — 5700 CE , 5600 CE hardly 20 lack OI

INFERENCE — does ALL of these point to – UPSIDE movt in NF in near term — 2-3 days — may be limited upside upto 5600 / 5700 is likely ? — pls comment — your expert opinion is always welcome — regards – dr vaibhav

Perfect analysis sir

Rgds,

Bramesh