Foreign Institutional Investors (FIIs) exhibited a Bearish Stance in the Bank Nifty Index Futures market by Shorting 9516 contracts with a total value of 715 crores. This activity led to a increase of 3780 contracts in the Net Open Interest.

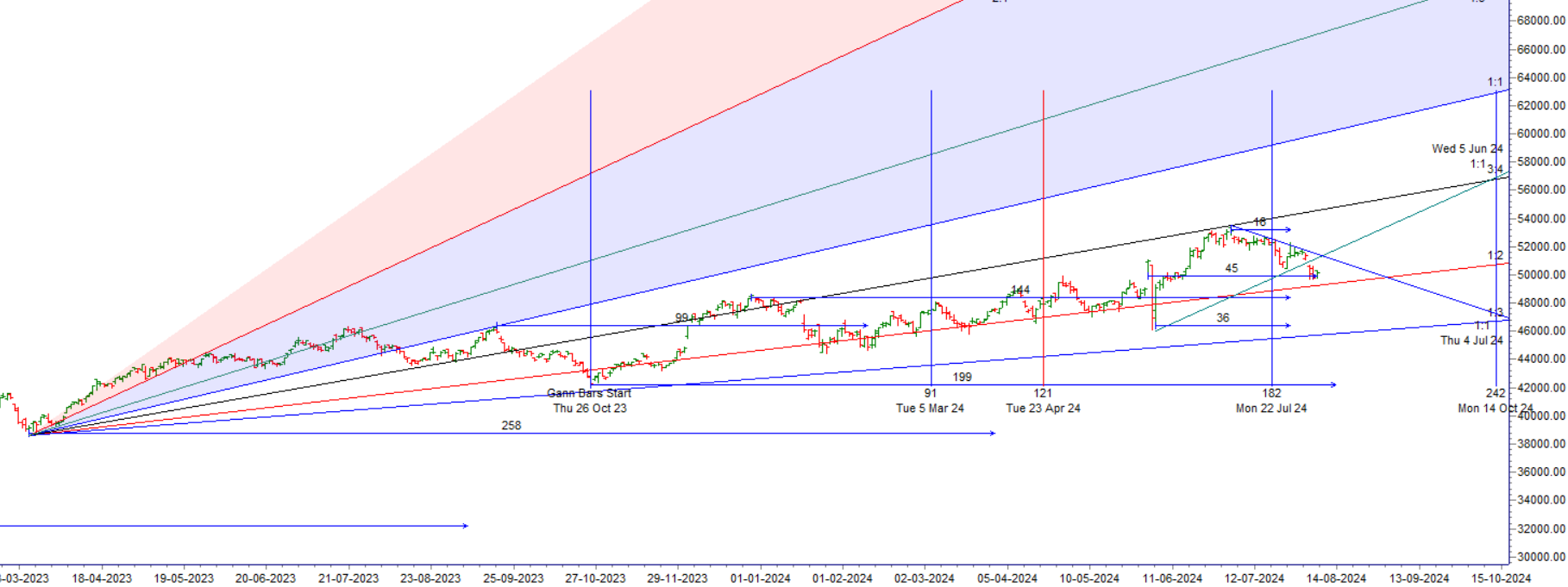

Bank Nifty continues to trade within the upper and lower bounds of the Gann angle, as shown in the chart below. The price has yet to break above the 52,340 high of the Saturn-Jupiter aspect or below the 51,546 low of the Jupiter-Saturn aspect. A break on either side can lead to a move of 666-729 points.

Patience is a crucial skill for traders, and waiting for the right trade setup is essential. Today, being the first day of the month, the market open will be an important level to watch to capture the trend for the day. The price will also react to the dovish Fed commentary from last night. Additionally, the recent 32k tax demand on Infosys might lead to a fall in IT stocks and a rise in bank stocks.

We have seen the impact of Mercury’s speed retrograde and the double ingress of Venus and Mercury, as discussed in the video below, on Bank Nifty.

Bank Nifty will be completing 45 days on 08 August from the 04 June low. According to Gann studies, 45 days are very significant. We also have “Bayer Rule 2: Trend goes down within 3 days when the speed difference between Mars and Mercury is 59 minutes, leading to a big move,” and the aspect of Venus conjunct Mercury, which is very significant for short-term swing trading. This confluence of Gann and astro cycles suggests we might see a big move today. The first 15 minutes’ high and low will guide the trend for the day.

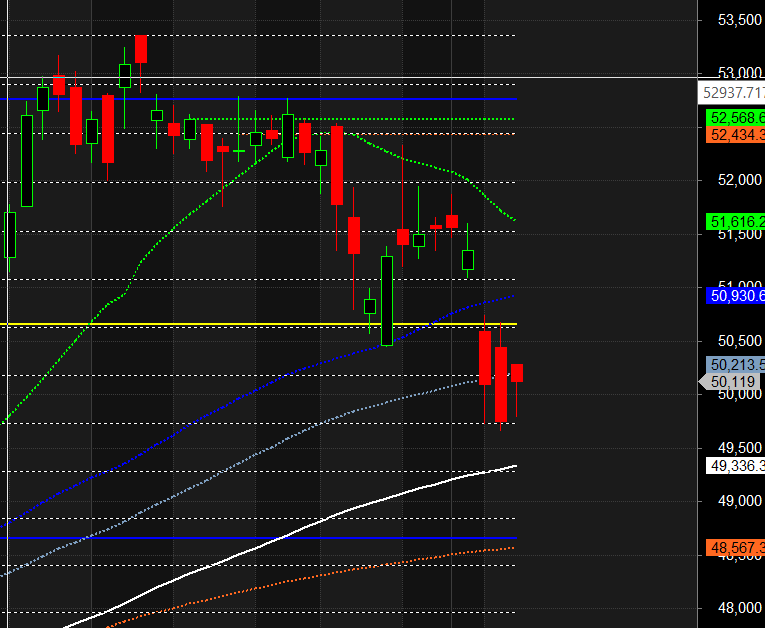

Bank Nifty Trade Plan for Positional Trade ,Bulls will get active above 50071 for a move towards 50297/50522/50747 . Bears will get active below 49846 for a move towards 49621/49395/49170

Traders may watch out for potential intraday reversals at 09:15,10:20,01:37,02:45,03:00 How to Find and Trade Intraday Reversal Times

Bank Nifty Aug Futures Open Interest Volume stood at 30.6 lakh, with liquidation of 0.05 lakh contracts. Additionally, the increase in Cost of Carry implies that there was a addition of SHORT positions today.

Bank Nifty Advance Decline Ratio at 10:02 and Bank Nifty Rollover Cost is @51740 closed above it.

Bank Nifty Gann Monthly Trade level :51353 closed below it.

Bank Nifty closed below 20/50 SMA @50390 Trend is Sell on Rise

Traders who follow the musical octave trading path may find valuable insights in predicting Bank Nifty’s movements. According to this path, Bank Nifty may follow a path of 48819-50271-51724-53263. This means that traders can take a position and potentially ride the move as Bank Nifty moves through these levels. Of course, it’s important to keep in mind that trading is inherently risky and market movements can be unpredictable.

According to the Bank Nifty options chain, the call side has the highest open interest (OI) at the 50200 strike, followed by the 50500 strike. On the put side, the 49800 strike has the highest OI, followed by the 49500 strike.This indicates that market participants anticipate Bank Nifty to stay within the 49800-50500 range.

The Bank Nifty options chain shows that the maximum pain point is at 50200 and the put-call ratio (PCR) is at 0.80. Typically, when the PCR open interest ranges between 0.90 and 1.05, the market tends to remain range-bound. PCR is on extreme end suggesting we can see sharp reversal .

Your losing trades do not diminish you as a person. You are not your losing trades. You are also not your winning trades either. They are simply by-products of the business that you’re in.

For Positional Traders, The Bank Nifty Futures’ Trend Change Level is At 50981 . Going Long Or Short Above Or Below This Level Can Help Them Stay On The Same Side As Institutions, With A Higher Risk-reward Ratio. Intraday Traders Can Keep An Eye On 50190 , Which Acts As An Intraday Trend Change Level.

BANK Nifty Intraday Trading Levels

Buy Above 50125 Tgt 50250, 50400 and 50555 ( BANK Nifty Spot Levels)

Sell Below 50000 Tgt 48864, 48610 and 48444 (BANK Nifty Spot Levels)

Wishing you good health and trading success as always.As always, prioritize your health and trade with caution.

As always, it’s essential to closely monitor market movements and make informed decisions based on a well-thought-out trading plan and risk management strategy. Market conditions can change rapidly, and it’s crucial to be adaptable and cautious in your approach.

DEAR BRAMESHSIR

I THINK THERE R SOME MISTAKE IN TODAYS BANKNIFTY LEVELS IN RED U GAVE 48864 BUT THERE IS VERY BIG GAPE PL CHECK N CORRECT

sure sir