- FII’s sold 1.8 K contract of Index Future worth 37 cores ,5.9 K Long contract were added by FII’s and 7.8 K Short contracts were added by FII’s. Net Open Interest increased by 13.7 K contract, so fall in Nifty was used by FII’s to enter long and enter short in Index futures.FII’s Long to Short Ratio at 1. Stock Market and State Elections Part -II

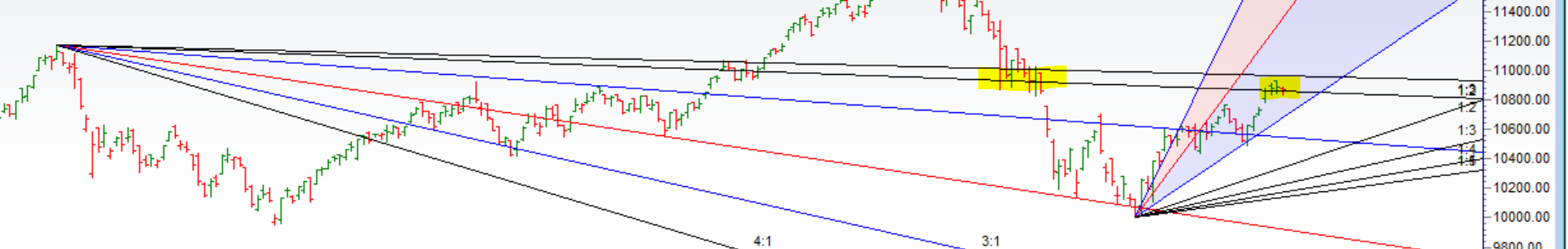

- As Discussed in Last Analysis Nifty Bulls held on to 10882 after opening with gap up as seen in below chart we are in whipsaw zone as election results overhang is also there, So be prepared for whipsaws and best is to do intraday trade. Bulls will get active above 10900 for a move towards 10950/ 11000/11100. Bears will get active below 10840 for a move back to 10777/10721/10666. Bears got active but unable to do follow up down move as i have mentioned we are in whipsaw zone and we again saw a low range day today, As we have RBI Policy tomorrow expect volatility around the policy time, Bulls will get active above 10900 for a move towards 10950/ 11000/11100. Bears will get active below 10820 for a move back to 10777/10721/10666 .We formed Important intraday time for reversal can be at 12:33/2:07. Bank Nifty Bulls fails to close above 27000,EOD Analysis

- Nifty Dec Future Open Interest Volume is at 2 core with addition of 2.3 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @10727 and rollover %@ 70.1

- 11000 CE is having Highest OI at 27.2 Lakh, resistance at 10800 followed by 1100 .10400-11000 CE added 0.07 lakh in OI so bears added position in range of 10600-10800. FII bought 9.6 K CE and 170 CE were shorted by them. Retail bought 68.7 K CE and 50.1 K CE were shorted by them.

- 10500 PE OI@35.2 Lakhs having the highest OI strong support at 10650 followed by 10600 . 10000-10700 PE added 8 Lakh in OI so bulls added position in range 10600-10700 PE. FII bought 5.8 K PE and 1.2 K PE were shorted by them. Retail bought 22.2 K PE and 24.9 K PE were shorted by them.

- Total Future & Option trading volume at1 4.70 Lakh core with total contract traded at 0.84 lakh , PCR @10.92

- FII’s sold 55.8 cores and DII’s sold 521 cores in cash segment.INR closed at 70.49 USD INR Crashes as Price Time Meets,Weekly Forecast

- Nifty Futures Trend Deciding level is 10900 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10896. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10890 Tgt 10910,10932 and 10950 (Nifty Spot Levels)

Sell below 10820 Tgt 10800,10775 and 10750 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh