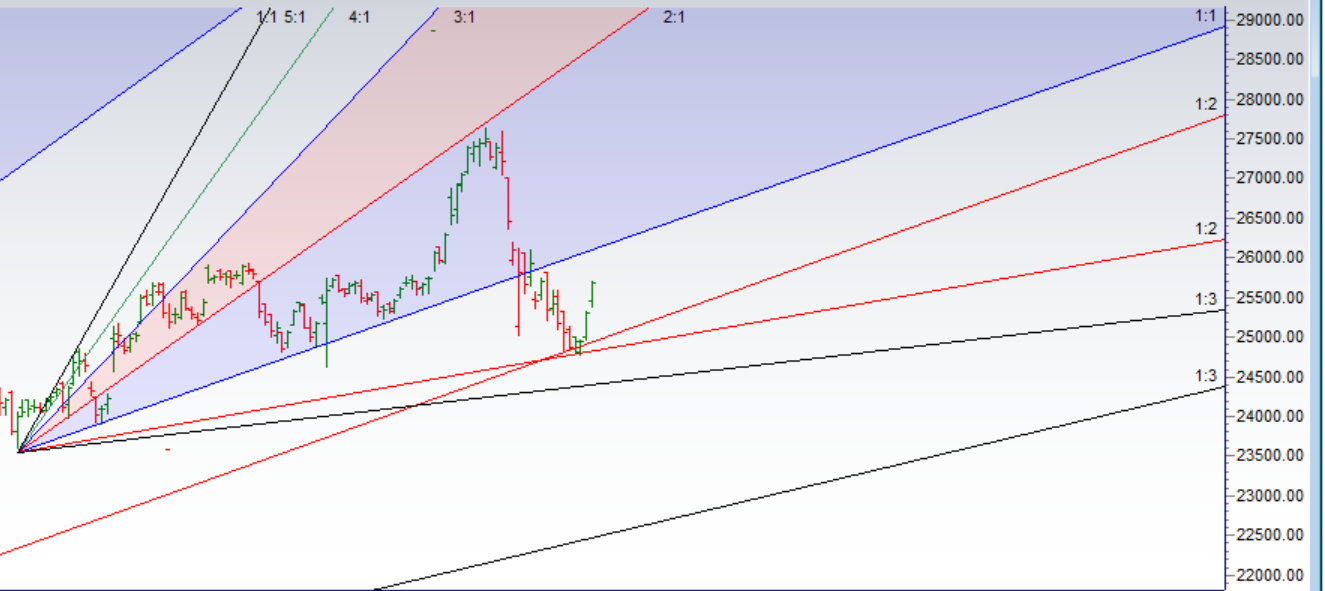

- As Discussed in Last Analysis Bank Nifty showed the effect of price time squaring rallying 350 points as we have discussed in last post. Bulls need to hold the range of 25050-25100 for this up move to continue towards 25500/25852. Bearish below 25000 for a move towards 24900/24760. 25500 done, High made today was 25722 we have bounced almost 700+ points from the level we did price time squaring. Now range of 25860-25920 is crucial zone of resistance. Bulls need a close above 25920 for the upmove to continue towards 26150. Bearish below 25250 only for a move towards 25120/25000. Important intraday time for reversal can be at 10:26/12:39 How to stay grounded in Trading.

- Bank Nifty March Future Open Interest Volume is at 20.2 lakh with addition of 5.8 Lakh, with decrease in Cost of Carry suggesting Long positions were closed today. Bank nifty Rollover cost @25010, rallied 700 points.

- 26000 CE is having highest OI @4.8 Lakh resistance at 26000 followed 26500.25000-27000 CE added 1.5 lakh in OI so bears added position at higher levels.

- 25000 PE is having highest OI @5.4 Lakh, strong support at 25000 followed by 24800.25000-27000 PE added 2.4 lakh in OI support at 25200-25300 at start of the series.

- Bank Nifty Futures Trend Deciding level is 25635 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 25284. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 25720 Tgt 25810,25920 and 25600 (Bank Nifty Spot Levels)

Sell below 25666 Tgt 25600,25520 and 25444 (Bank Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Sir where do you source data into Gann Analyst as I can’t find a way to load data.

Metastock or csv data

Sir which charting software do you use for analysis?

Thanks in advance.

Gann Analyst