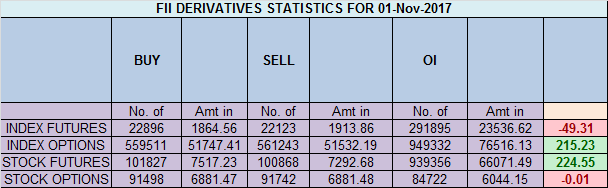

- FII’s bought 773 contract of Index Future worth 49 cores ,7.8 K Long contract were added by FII’s and 7 K Short contracts were added by FII’s. Net Open Interest increased by 14.9 K contract, so rise in market was used by FII’s to enter long and enter short in Index futures. FII’s Long to Short Ratio at 2 The Secret To Day Trading Success

- As discussed in last analysis Bulls weer unable to provide the follow up move above 10355 and were not able to do target of 10410, Bears were unable to break 10300. 02 Nov is again an important turn date so we can see effect tomorrow or on 02 Nov. Bearish below 10300 for a move towards 10240/10140/10090. Bullish above 10355 for a move towards 10410/10471/10600. Time cycle helped us again in capturing the range breakout as we discussed yesterday Nifty opened with a gap above 10355 and rallied to do our target of 10410 and high made was near 2 target of 10470 which should be done by tomorrow. Till we are holding above 10410 we can rally all the ways till 10576/10600. Bearish below 10300 only. Bank Nifty ready for range breakout,EOD Analysis

- Nifty Nov Future Open Interest Volume is at 2.43 core with addition of 5.8 Lakh with decrease in cost of carry suggesting Short position were added today, NF Rollover cost @10280 closed above it.

- Total Future & Option trading volume at 6.93 Lakh core with total contract traded at 0.93 lakh , PCR @1.08

- 10500 CE is having Highest OI at 34.2 Lakh, resistance at 10500 followed by 10600 .10000-10500 CE liquidated 0.75 Lakh in OI so bears covered partial position in range of 10200-10300 even after 100 point rise. FII bought 19.6 K CE and 1.3 K CE were shorted by them. Retail sold 24.3 K CE and 1.2 K CE were shorted by them

- 10200 PE OI@47.6 lakhs having the highest OI strong support at 10200 followed by 10150. 10000-10500 PE added massive 31 Lakh in OI so bulls added major position in 10000-10200 PE. FII sold 188 PE and 19.8 K PE were shorted by them. Retail bought 115 K PE and 55.2 K PE were shorted by them.

- FII’s bought 1038 cores and DII’s sold 667 cores in cash segment.INR closed at 64.59

- Nifty Futures Trend Deciding level is 10456 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10384. Yesterday closed above TC level and rallied 100 points How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10450 Tgt 10480,10506 and 10530 (Nifty Spot Levels)

Sell below 10410 Tgt 10383,10357 and 10340 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh