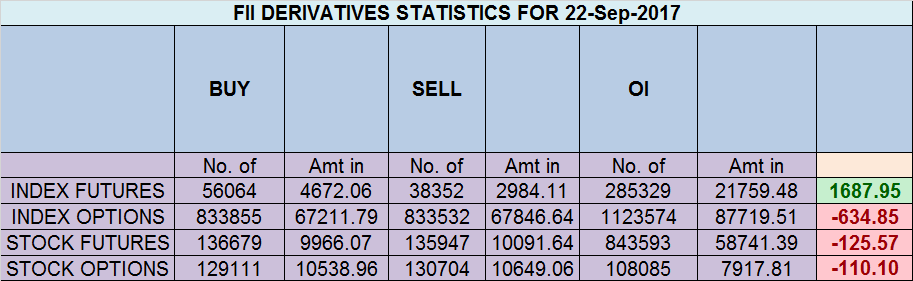

- FII’s bought 17.7 K contract of Index Future worth 1687 cores ,12.5 K Long contract were added by FII’s and 5.1 K Short contracts were covered by FII’s. Net Open Interest increased by 7.3 K contract, so fall in market was used by FII’s to enter long and exit short in Index futures. FII’s Long to Short Ratio at 1.2. “Giving” it the way Karna does…

- As discussed in last analysis Another failed attempt to cross 10171, 2 small days of consolidation and again we protected gann angle again, expect a good move in nifty in coming 2 trading sessions. Bullish above 10171 for a move towards 10236/10300. Bearish below 10100 for a move towards 10030/9970. 23 Sep is an important time cycle date,effect will be seen either tomorrow or Monday. Its a Deja Vu trade in Nifty today everything was so perfect High made was 10095 big fall started towards 9970, When both time and price meet big move happens, Price was 10100 and Time was 23 Sep but as Holiday so effect was seen today. Traders should watch 9930 for next round of move, Bearish below 9930 for a move towards 9820/9770. Bullish above 10000 for a move towards 10055/10140. Bank Nifty does Price Time Squaring and gave big move

- Nifty September Future Open Interest Volume is at 2.04 core with liquidation of 1.8 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @9910 Closed above it and rallied 250 points.

- Total Future & Option trading volume at 6.99 Lakh core with total contract traded at 1.63 lakh , PCR @0.94

- 10200 CE is having Highest OI at 64.4 Lakh, resistance at 10200 followed by 10100 .9900-10500 CE added huge 78.4 Lakh in OI so bears added major position in range of 10100-10200, suggesting expiry below 10100. FII sold 10.1 K CE and 39.8 K CE were shorted by them. Retail bought 197 K CE and 80.5 K shorted CE were covered by them

- 9900 PE OI@42.1 lakhs having the highest OI strong support at 9900 followed by 9800. 9900-10500 PE liquidated 68 Lakh in OI so bulls covered position in 9900-10000 PE. FII sold 12.5 K PE and 8.3 K PE were shorted by them. Retail sold 92.8 K PE and 82.4 K PE were shorted by them

- FII’s sold 1241 cores and DII’s bought 521 cores in cash segment.INR closed at 64.79

- Nifty Futures Trend Deciding level is 10025 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10041. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9980 Tgt 10005,10030 and 10055 (Nifty Spot Levels)

Sell below 9960 Tgt 9930,9910 and 9885 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

sir,kindly i request u 2 publish an article on how to draw Gann angle .Is it correct to draw 1×1 Gann angle at 45 degree or the relation price=time2 to be used for calculating slope.please write an article about it. Thanks in advance