- FII’s bought 1.4 K contract of Index Future worth 63 cores ,1.4 K Long contract were added by FII’s and 31 Short contracts were added by FII’s. Net Open Interest increased by 1.4 K contract, so fall in market was used by FII’s to enter long and enter short in Index futures. Trading Sins

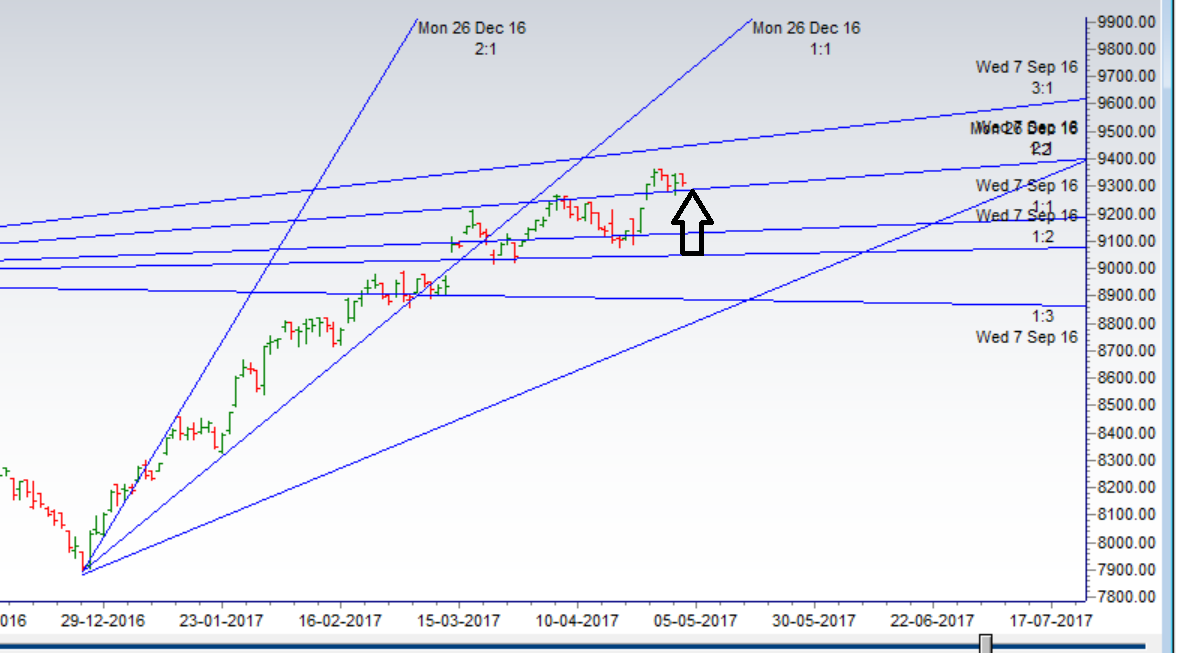

- As discussed in last analysis As per time cycle 01 May is crucial as it being holiday we should see good move in coming week. Long above 9367 for move till 9424/9468 and bearish below 9274 for move till 9220/9170. High made today was 9346 and low made was 9298 so nifty continue to trade in range of 9367-9274, and in the process took support near gann angles from last 3 trading days, Best strategy to trade this market buy low and sell high till we see range breakout/breakdown. Trend traders should wait for range expansion above 9367 or below 9274 for taking fresh trades. Bank Nifty continue its range play,EOD Analysis

- Nifty May Future Open Interest Volume is at 1.95 core with addition of 2.24 Lakh with increase in cost of carry suggesting Long position were added today, NF Rollover cost @9307 Closed above it.

- Total Future & Option trading volume at 3.67 Lakh core with total contract traded at 0.69 lakh , PCR @1

- 9500 CE is having Highest OI at 49.9 lakh, resistance at 9500 followed by 9400 .9000-9500 CE added 9.7 Lakh in OI so bears continue to add in 9400-9500 CE.FII bought 4.3 K CE longs and 1.2 K shorted CE were covered by them.Retail bought 36.5 K CE contracts and 33.1 K CE were shorted by them.

- 9000 PE OI@47.8 lakhs having the highest OI strong support at 9200 followed by 9100. 9000-9500 PE added 14.5 Lakh in OI so bulls added in 9100/9200 PE . FII bought 14.4 K PE and 5.2 K PE were shorted by them. .Retail bought 23.1 K PE contracts and 24.4 K PE were shorted by them.

- FII’s sold 517 cores in Equity and DII’s bought 112 cores in cash segment.INR closed at 64.14

- Nifty Futures Trend Deciding level is 9340 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9341. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9320 Tgt 9347,9368 and 9394 (Nifty Spot Levels)

Sell below 9300 Tgt 9270,9250 and 9230 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

hi, can you please provide me details on your trading course ?

Hello Sir,

I am Investor and regular follower of your post and visit your page daily, but could not understand the calculations done.

Request you to explain the calculation done by you for the no of long and short contracts added. also request to share the source and calculations done for PE and CE contracts bought or sold by FII.

This explantion will enhance my understanding.

Thanking you.

Sudha

We cover the same in our trading courses.