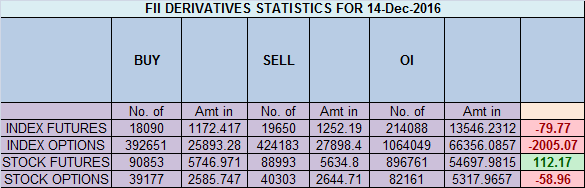

- FII’s sold 1.5 K contract of Index Future worth 79 cores ,0.4 K Long contract were liquidated by FII’s and 1.1 K short contracts were added by FII’s. Net Open Interest increased by 0.6 K contract, so fall in market was used by FII’s to exit long and enter shorts in Index futures. How To get rid of Bad Trading Habits

- As discussed in last analysis Low made today was 8154 near the horizontal line as seen in below gann chart as soon as 8185 crossed nifty bounced back and made high of 8226 and mostly 8250 will be done tomorrow. Now again closed above 8250 will be bullish and extended target comes at 8330/8370. Low made today was 8165 again bears were unable to break 8154 and bulls were unable to break 8250, so zone of 8154-8250 is like no trade zone for trend followers and paradise for scalper :). As Time Cycle is changing so expect this range to break in next 2 trading sessions. Above 8250 target 8330/8370/8444. Below 8150 target 8100/8050/7972. Bank Nifty Looking ripe for range breakout ,EOD Analysis

- Nifty Dec Future Open Interest Volume is at 1.65 core with liquidation of 3.7 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8049 closed above it.

- Total Future & Option trading volume at 2.40 Lakh core with total contract traded at 1 lakh , PCR @1.04.

- 8300 CE is having Highest OI at 53.8 lakh, resistance at 8300 followed by 8500 .7900/8500 CE added 9.2 lakh so bears added aggressively 8300/8400 CE .FII sold 101 K CE longs and 14.2 K CE were shorted by them .Retail bought 61.7 K CE contracts and 22.4 K CE were shorted by them.

- 8000 PE OI@80.3 lakhs having the highest OI strong support at 8000. 7900-8500 PE added 0.63 Lakh in OI so bulls added again in small 8200/8300 PE. FII sold 1.4 K PE longs and 5.5 K PE were shorted by them .Retail bought 29.3 K PE contracts and 18.5 K PE were shorted by them.

- FII’s sold 632 cores in Equity and bought 210 cores in cash segment.INR closed at 67.44

- Nifty Futures Trend Deciding level is 8203 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8175 . How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8256 Tgt 8283,8310 and 8330 (Nifty Spot Levels)

Sell below 8150 Tgt 8125,8100 and 8066 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

8203 is the trend reversal which is broken from 8122 , your suggestion on this!