- FII’s sold 18.6 K contract of Index Future worth 1120 cores ,22.5 K Long contract were liquidated by FII’s and 3.9 K short contracts were liquidated by FII’s. Net Open Interest decreased by 26.4 K contract, so fall in market was used by FII’s to exit long and exit shorts in Index futures. With self-confidence & Perseverance, Never Give Up

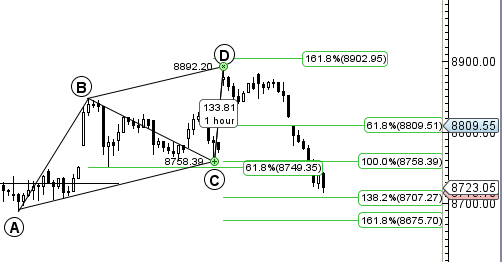

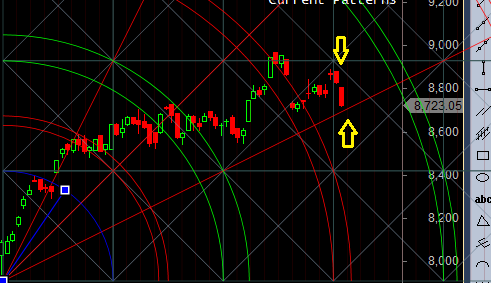

- As discussed last Analysis Now for next 2 days range of 8910-8928 is very crucial zone unable to close above it nifty can see another round of down move towards 8760/8700. There are 2 cycle working currently for nifty one from 8968 which was price and time square and another one was from 8750 , both are price and time square, market has to break anyone of the level for trending move, else we will keep rotating in this range. Bulls need a close above 8928 for a move till 8968/9056/9120, Bear below 8700. Bulls again failed to close above 8910-8928 range, when 2 cycle are at work such choppy moves are bound to happen, its like both bulls and bears are trying hard but none of them are succeeding, Also we are forming a bearish ABCD pattern which showed its effect last friday , we can correct till 8809/8758/8700 in short term. Bullish only on close above 8928. 8715 low made today and close below 8750 level, suggesting bears have upper hand now can push nifty towards 8675/8650 levels which is extended ABCD pattern target, As we are near gann angle so if we hold on to 8700 tomorrow we can see bounce back till 8787/8806/8832 levels. Close below 8700 can push index towards 8650/8577 levels, exciting expiry coming. Bank Nifty corrects 600 points from gann line of resistance,EOD Analysis

- Nifty Sep Future Open Interest Volume is at 2.49 core with liquidation of 63.4 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8686, closed above it rallied 250 points.

- Total Future & Option trading volume was at 4.85 Lakh core with total contract traded at 2.11 lakh , PCR @0.94 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 65.2 lakh, resistance at 9000 .8500/9000 CE added 35.6 lakh so bears added aggressively in 8750-8800 CE .FII sold 7.1 K CE longs and 11.4 K CE were shorted by them .Retail bought 109 K CE contracts and 45.6 K shorted CE were covered by them.

- 8500 PE OI@59.7 lakhs having the highest OI strong support at 8500. 8500-9000 PE liquidated 23 Lakh in OI so bulls ran for cover as 8750 level gave in .FII bought 25.5 K PE longs and 2.9 K PE were shorted by them .Retail sold 35.8 K PE contracts and 5.9 K PE were shorted by them.

- FII’s sold 206 cores in Equity and DII’s sold 113 cores in cash segment.INR closed at 66.61

- Nifty Futures Trend Deciding level is 8874 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8808 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8750 Tgt 8782,8809 and 8843 (Nifty Spot Levels)

Sell below 8700 Tgt 8688,8656 and 8620 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Oops Sorry Typo Error..

Exciting Expiry…

Respected Sir,

Thank you for your Hardwork…

Yes It will be an Exciting weekend.