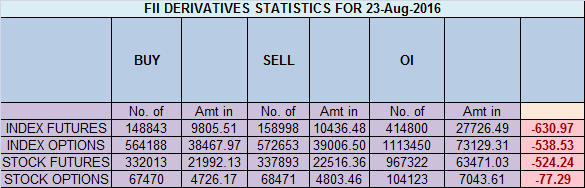

- FII’s sold 10.1 K contract of Index Future worth 631 cores ,7.3 K Long contract were added by FII’s and 17.4 K short contracts were added by FII’s. Net Open Interest increased by 24.7 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. Are you Addicted to trading ?

- As discussed in Yesterday Analysis Now Bulls need to close above the range of 8711 for next move towards 8779-8800-8851. Bears will get active on close below 8484 only. Its been 21 days we have traded in range of 204 points 8517-8721, suggesting market is seeing time correction frustrating traders and hitting SL, traders who survive this phase by applying risk and money management are rewarded handsomely in the next move . High made today was 8642 so bulls need to wait for break of 8711-8723 range for further upmove. Low made today was 8580 near our important gann level of 8577 which we have discussed many time in our past analysis and also formed hammer candlestick near gann trendline as shown below. Bulls above 8723 can see move till 8851/8900, bears below 8484 can see move till 8400/8350. As per gann analysis 23-24 Aug are important trend change date so we might see end of time correction near that time. Bank Nifty took support at gann trendline, EOD Analysis

- Nifty Aug Future Open Interest Volume is at 1.23 core with liquidation of 58 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8650, closed below it, trading near rollover range suggesting big move round the corner.

- Total Future & Option trading volume was at 4.51 Lakh core with total contract traded at 2.2 lakh , PCR @0.93 , Trader’s Resolutions for the New Financial Year 2016-17

- 8800 CE is having Highest OI at 67.9 lakh, resistance at 8800 .8500/9000 CE liquidated 38.3 lakh so resistance formation in 8800-8900 zone .FII bought 4.4 K CE longs and 0.9 K CE were shorted by them .Retail bought 3.1 K CE contracts and 1.1 K CE were shorted by them.

- 8400 PE OI@57.7 lakhs having the highest OI strong support at 8400. 8300-8800 PE added 13.1 Lakh in OI so bulls making strong base near 8550-8500 zone .FII sold 1.6 K PE longs and 1.4 K PE were shorted by them .Retail bought 33 K PE contracts and 21.6 K PE were shorted by them.

- FII’s sold 0.19 cores in Equity and DII’s sold 452 cores in cash segment.INR closed at 67.18

- Nifty Futures Trend Deciding level is 8624 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8660 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8656 Tgt 8680,8719 and 8740 (Nifty Spot Levels)

Sell below 8615 Tgt 8595,8577 and 8550 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

sir, 23 and 24 august is finished, but time correction is not finished yet,?

tomorrow expiry, maximum earn by option writer, but what after that

We are up almost 80 point from the low of 23 Aug

Sir, Whenever you say its a time correction, the market responds sharply after that time correction.

you have also mentioned the respective goal post levels for long and short too.Thanks

Hi Bramesh Ji

If i am buying Nifty above 8656 then what will be the stop loss level i have to put. 8615 or 10 points or 20 points. which will be the right stop loss level to put.

Please suggest.

Thanks

21 points

Thank you very much Bramesh JI

do you call tilted lines as horizontal– then what are those real horizontal lines? are those just to draw curves/get squares. note…. i dont know gann lines.

yup

Dont assume anything bhai .Just follow and stick to trend and apply risk management as Sir has been saying .

No bear market tI’ll nifty not get 10000 level

sir, NF closed above rollover?

Sir,

Please Suggest me on one point..

Today PCR Value is indicating less than 1… There is a detailed Lesson by you, How PCR Value has to be considered.

So, Now shall I assume assume… this is beginning of Bear Market…

Please Reply to my Question.

Awaiting for your answer.

Thank you.

no