In Continuation With Last Article

Ranging Markets

Set overbought and oversold levels based on observation of past price behavior.

- Go long when Detrended Price Oscillator crosses below and then back above the oversold level.

- Go short when Detrended Price Oscillator crosses above and then back below the overbought level.

Trending Markets

Only trade in the direction of the trend.

- Go long when Detrended Price Oscillator crosses below zero and then turns back above.

- Go short when Detrended Price Oscillator crosses above zero and then turns back below.

Divergence

When divergence appears between Detrended Price and the price, it indicates a high probability that the current trend will finish soon.

Buy Signal is when a new Low is formed below the previous one and a corresponding Detrended Price value is higher than the previous one.

Short signal is when a new High is formed above the previous one and a corresponding Detrended Price value is lower than the previous value.

Let Analyze how to trade using Detrended Price Oscillator

Identifying turning points in Stock Cycle

The cycles are created because the indicator is displaced back in time. The historical peaks and troughs in the Detrended Price Oscillator provide approximate windows of time when it is favorable to look for entries and exits, based on other indicators or strategies.

In the example below, stock is International Business Machines (NYSE:IBM) is bottoming approximately every 24 to 30 trading days. Upon noticing the cycle, look for buy signals that align with this time frame. Peaks in price are occurring every 35 to 41 trading days look for sell/shorting signals that align with this cycle.

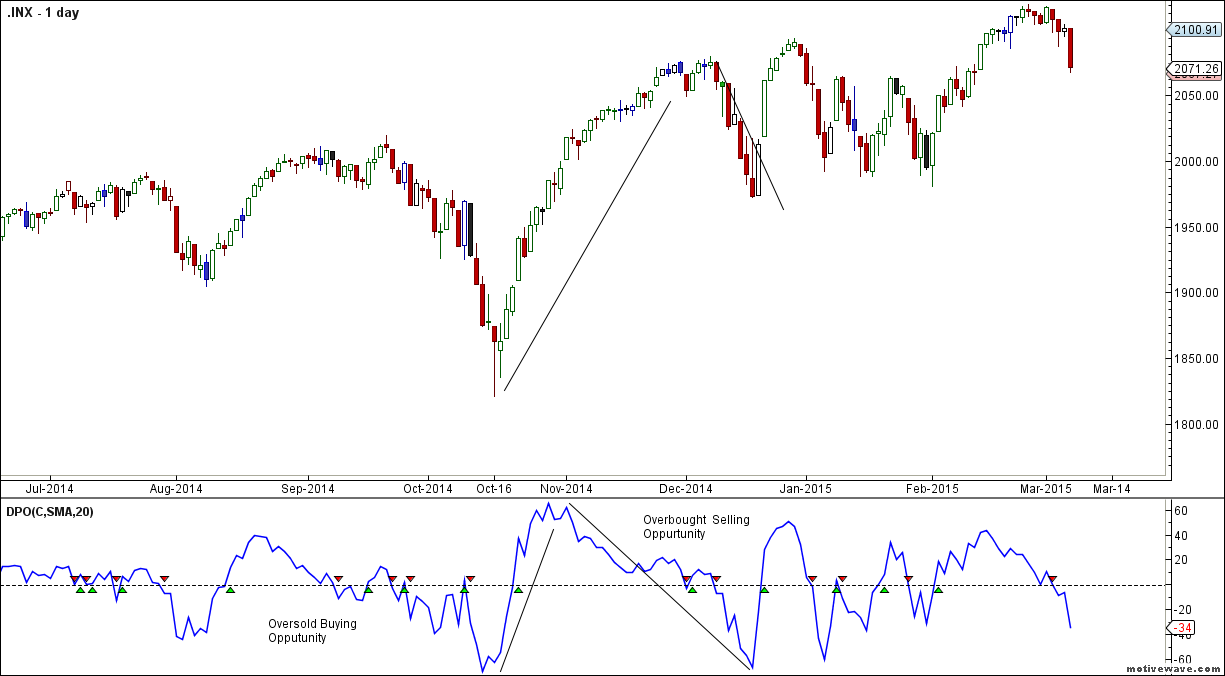

Let’s take another example of S&P 500 to show how Detrended Price Oscillator helps in taking both long and short trades

The chart of the S&P 500 visually depicts the Detrended Price Oscillator:

When the Detrended Price Oscillator is above the zero line, it means that price is above its moving average which is a bullish sign. Similarly, when the Detrended Price Oscillator is below the zero line, it means that price is below its moving average, a bearish sign.

Using the above concepts lets analyze the above S&P 500 chart

On 16th October 2014 S&P 500 made low of 1820 and showed an intraday recovery and closed at 1862. Detrended Price Oscillator was in oversold zone and on 21st Oct Detrended Price Oscillator closed above zero line suggesting Longs can be initiated@1941 with SL of previous day’s low.

Profit booking can be done @2017 on 04-Nov when Detrended Price Oscillator reached overbought zone.

On 09th Dec 2014 S&P 500 made low of 2054 and closed @ 2060 and Detrended Price Oscillator crossed below zero line suggesting shorts can be taken with SL of day’s High.

Profit booking can be done @1982 on 16th Dec when Detrended Price Oscillator reached oversold zone.

Using Divergence

As discussed above Short signal is when a new High is formed above the previous one and a corresponding Detrended Price value is lower than the previous value.

The chart of the NIKE visually depicts the Detrended Price Oscillator with Divergence.

Using the above concepts lets analyze the below NIKE chart

Between 26th Feb 2014 to 18th March 2014 Nike was trading in range of 78-80, making Higher Highs But Detrended Price Oscillator was making Lower lows as shown in the below chart, suggesting it indicates a high probability that the current trend will finish soon.

On 21st March 2014 NIKE opened gap down 77 and by 7th April 2014 made low 70.

Conclusions

The Detrended Price Oscillator shows the difference between a past price and a simple moving average. In contrast to other price oscillators, DPO is not a momentum indicator. Instead, it is simply designed to identify cycles with its peaks and troughs. Cycles can be estimated by counting the periods between peaks or troughs. Users can experiment with shorter and longer DPO settings to find the best fit.

thank you sir.

sir, can we use this for 5/10/15 min.. if so what value ? 14 ?.

yes sir