Arvind

Positional/Swing Traders can use the below mentioned levels

Close above 298 Tgt 315/326

Intraday Traders can use the below mentioned levels

Buy above 297 Tgt 300,302.8 and 306 SL 295

Sell below 292 Tgt 288,285 and 280 SL 295

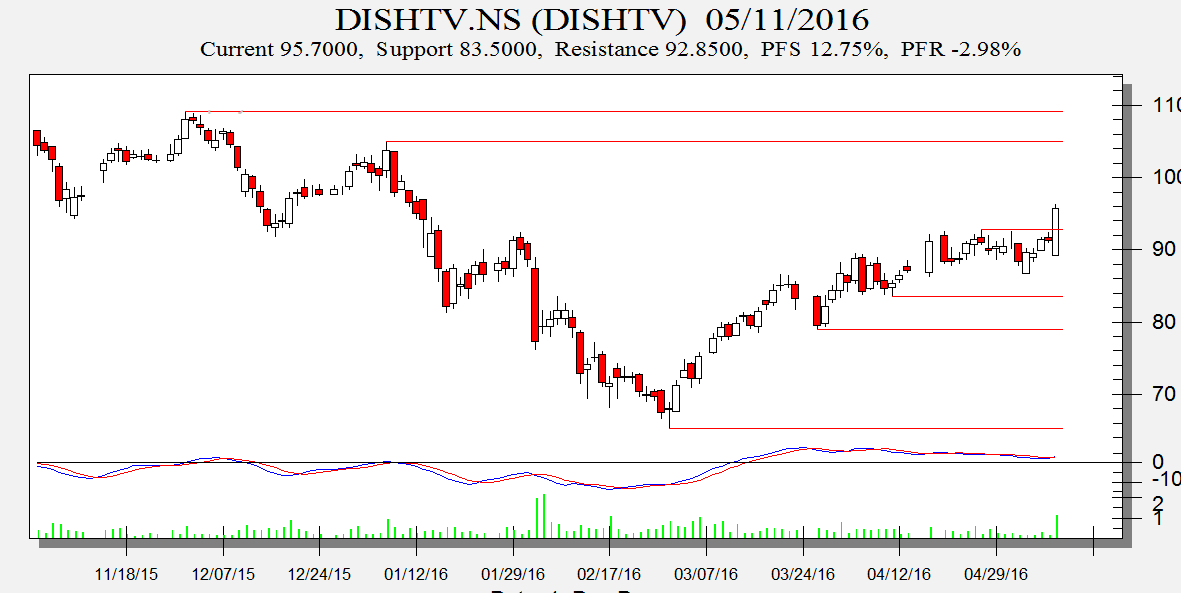

Dish TV

Positional/Swing Traders can use the below mentioned levels

Close above 97 Tgt 102/110

Intraday Traders can use the below mentioned levels

Buy above 96.5 Tgt 98,99 and 100 SL 95.7

Sell below 93.5 Tgt 92.5,91 and 90 SL 94.5

SKS Micro

Positional/Swing Traders can use the below mentioned levels

Close below 585 Tgt 555

Intraday Traders can use the below mentioned levels

Buy above 588 Tgt 594,600 and 610 SL 584

Sell below 582 Tgt 577,570 and 562 SL 585

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for April Month, Intraday Profit of 1.92 Lakh and Positional Profit of 4.61 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Dear Bramesh… I constantly watch out some real great recommendations from you! Congrats for that.

Would you mind explaining to your readers…if the Swing Trade is based purely on pivotal support/resistance? Thank you!

Its based on Supply/Demand Gann Harmonics

Rgds,

Bramesh