- FII’s sold 22.2 K contract of Index Future worth 1224 cores ,13.6 K Long contract were liquidated by FII’s and 8.5 K short contracts were added by FII’s. Net Open Interest decreased by 5 K contract, so fall in Nifty market was used by FII’s to exit long and enter shorts in Index futures.Are you Victim of “Over Trading”

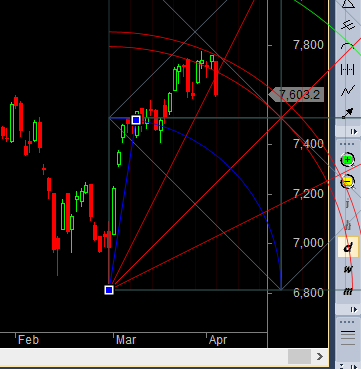

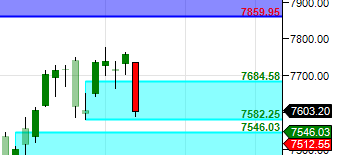

- As discussed in last analysis Close below 7741 will be bearish in short term and nifty can correct till 7600/7519. Nifty High of today was 7736 below 7740 and also major gann swing date today gave a lethal combo and nifty corrected all the way till 7588, Now the support is near 7546-7519 range and resistance around 7684 so market can swing in both the levels for sometime before making the next major move. Bank Nifty breaks 16000 and gann trendline, EOD Analysis

- Nifty April Future Open Interest Volume is at 1.78 core with liquidation of 9.2 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @7740, broken it.

- Total Future & Option trading volume was at 2.8 Lakh core with total contract traded at 2.6 lakh , PCR @0.79, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 72.7 lakh, resistance at 8000 .7500/8000 CE added 51 lakh so bears gave blow out punch to bulls added in range of 7700/7800 .FII bought 12.9 K CE longs and 44.5 K CE were shorted by them .Retail bought 116 K CE contracts and 40.5 K CE were shorted by them.

- 7500 PE OI@50 lakhs having the highest OI strong support at 7500. 7000-7600 PE added 19.3 Lakh in OI so strong base near 7500/7400 .FII bought 39.7 K PE longs and 2.4 K shorted PE were covered by them .Retail sold 15.5 K PE contracts and 38.6 K PE were shorted by them.

- FII’s sold 800 cores in Equity and DII’s bought 56 cores in cash segment.INR closed at 66.20

- Nifty Futures Trend Deciding level is 7683 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7746 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7643 Tgt 7665,7680 and 7710 (Nifty Spot Levels)

Sell below 7580 Tgt 7550,7525 and 7495 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-140117182685863/

Hi sir can u tell me abt ceat stuck with short

bears gave blow out punch to bears

I think it should be bulls.

Retails seem to have bought a HUGE number of call options while today’s FII analysis does not seem to point to any reasonable upmove. Even the gann trend lines are far from where we closed today.

Perfect !! thanks its corrected

Good Evening Bramesh ji,

Please correct my obseration : Retailers are more on long side buying CE’s and Shorting PE’s while FII’s are vice versa.

Perfect..