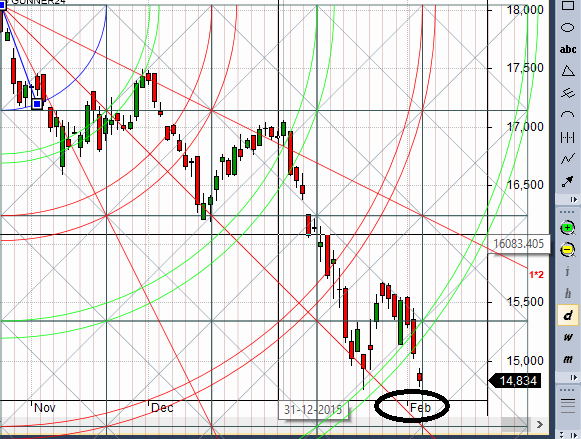

- As discussed in last analysis Bank Nifty broke gann arc in the process which increase possibility of bank nifty heading towards 14754. Bulls needs to close above 15237 else we will break the low of 14754. Bank Nifty made low of 14777 near the last swing low of 14754 as we have been expecting after it broke the gann arc, Now if we hold 14750 we can see bounceback till 15000/15237, Weekly close below 14754 can lead bank nifty towards 14338 where we have next support zone. How to Manage Trading Stress

- Bank Nifty February Future Open Interest Volume is at 25.4 lakh with liquidation of 0.28 Lakh with increase in Cost of Carry suggesting short positions were closed today .Bank Nifty again gave 700 points move below rollover cost @ 15441. How To Identify Market Tops and Bottom

- 16000 CE is having highest OI @8 Lakh strong resistance formation @16000. 15500 CE saw 0.94 Lakh addition by bears so 15500 was sealed by bears for time being .15000-16500 CE added 2.9 Lakh in OI. 14500-16500 looks the range for Feb series.

- 14500 PE is having highest OI @4.5 lakh, strong support at 14500 and 14100 is next strong support looking at OI addition.14500-16500 PE saw 0.40 lakh liquidation so bulls adding at lower strike prices ran for cover but still not liquidated aggressively.

- Bank Nifty Futures Trend Deciding level is 14920 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 15307.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Traders who took trade as per TC levels are rewarded with almost 2000 Points

Buy above 14850 Tgt 14930,15020 and 15110 (Bank Nifty Spot Levels)

Sell below 14750 Tgt 14690,14580 and 14400 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates