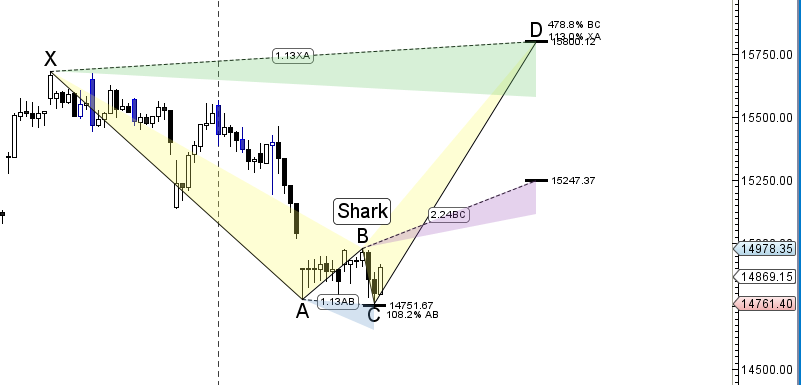

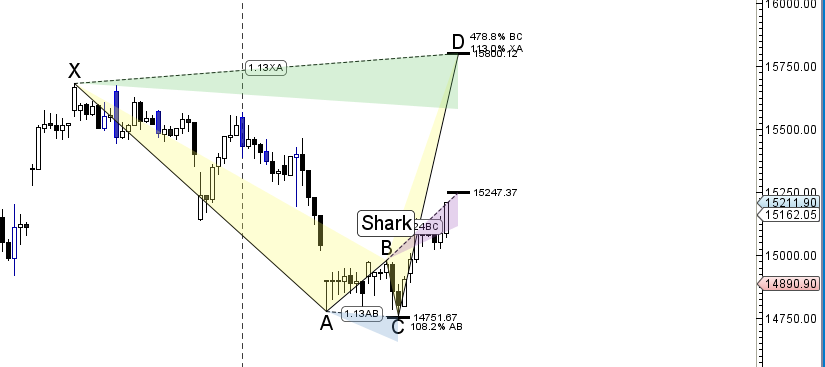

- As discussed in last analysis Bank Nifty is forming a SHARK Pattern in hourly so holding 14754 we can see bounce back till 15237 in next 2 days. Bank Nifty did target as shown in below chart high made was 15212, now bulls needs close above 15250 for next round of move till 15500/15600. Breakout will happen above 15713. Paul Tudor Jones explaining Why FAILURE is important

How To Improve Trading Success

How To Improve Trading Success

- Bank Nifty February Future Open Interest Volume is at 25.9 lakh with addition of 0.20 Lakh with increase in Cost of Carry suggesting long positions were added today .Bank Nifty again gave 700 points move below rollover cost @ 15441. How To Identify Market Tops and Bottom

- 16000 CE is having highest OI @8.2 Lakh strong resistance formation @16000. 15500 CE saw 0.38 Lakh addition by bears so 15500 was sealed by bears for time being will be tested in next few sessions .15000-16500 CE liquidated 0.32 Lakh in OI so finally started covering their positions as Bank nifty bounced from demand zone.

- 15000 PE is having highest OI @5.4 lakh, As we discussed yesterday eventhough Bank Nifty closed below 15000 for 2 day in row suggesting Bulls are entering position so we might see weekly closing above 15000.14500-16500 PE saw 0.97 lakh addition so bulls adding at lower strike prices as Bank Nifty bounced for demand zone again.

- Bank Nifty Futures Trend Deciding level is 15133 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 15229.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Traders who took trade as per TC levels are rewarded with almost 2000 Points

Buy above 15240 Tgt 15300,15380 and 15555 (Bank Nifty Spot Levels)

Sell below 15060 Tgt 14960,14890 and 14770 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates