- FII’s sold 4.6 K contract of Index Future worth 322 cores ,5.9 K Long contract were added by FII’s and 10.5 K short contracts were added by FII’s. Net Open Interest increased by 16.4 K contract, so today’s rise/fall in market was used by FII’s to enter long and enter shorts in Index futures. GST impact on Indian Economy

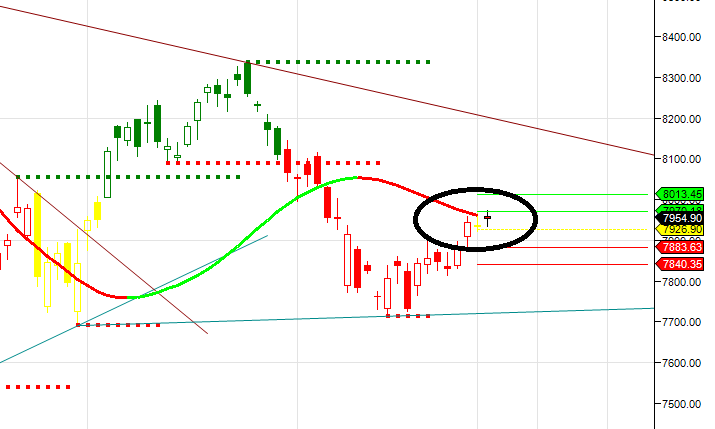

- Nifty formed another DOJI pattern after 2 days of rally consolidating the gains. Nifty is nearing trend change as shown in gann swing chart, Closing above 7994 will lead to trend change on upside, Till 7906 is held we can move towards 7994/8051/8116, Support is at 7906/7851. Bank Nifty forms INSIDE Day,EOD Analysis

- Nifty December Future Open Interest Volume is at 1.95 core with addition of 3 Lakh with increase in CoC suggesting long position were added today. Nifty closing above rollover cost 7896.

- Total Future & Option trading volume was at 1.39 Lakh core with total contract traded at 1.06 lakh , PCR @0.82.

- 8500 CE OI at 42 lakh , wall of resistance @ 8500 .7800/8500 CE added 27.6 lakh in OI as bears added position at higher level most of addition was seen in 8300/8500 CE.FII bought 31.7 K PE longs and 24.6 K PE were shorted by them .Retail bought 13 K PE contracts and 17.9 K PE were shorted by them.

- 7500 PE OI@ 47.3 lakhs strong base @ 7500. 7500/8000 PE added 2.3 lakh so bulls added position is 7700/7800 PE forming base at higher levels .FII bought 13.6 K PE longs and 2.5 K shorted PE were covered by them .Retail bought 8 K PE contracts and 13.7 K PE were shorted by them.

- FII’s sold 107 cores in Equity and DII’s bought 198cores in cash segment.INR closed at 66.48.

- Nifty Futures Trend Deciding level is 7985 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7958 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7960 Tgt 7985,8003 and 8051 (Nifty Spot Levels)

Sell below 7915 Tgt 7898,7875 and 7850 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Very well said Amit Ji. I really admire the efforts taken by Ramesh B to enlighten us about the movements in the market on daily basis.His writing is analytical and he doesn’t imposes his own views about the future movement of market.He only states the facts as they are.It is up to the individual to follow or not follow his analysis.If someone doesn’t believe in W D Gann’s theory he need not waste his time reading the contents of this website

Regards

Rishikesh V

you might have read my post… It was never offensive or derogatory aganist any one… It was just simple question i raised… Bramesh was rattled so much that he posted reply after reply even i can reply back.. But my time is presious.. Any way i dont have any unilateral view of markets… My viewsconsidering all markets and trigger points in domestic market …. Ill change my view once i make consistent losses..

Anger & rudeness is false show of strength by a weak person

While politeness & cool mind reflects dignity and strength of a strong person

Gm…… friends

Sree Krishna, this post is for students who gather overall perspective of the game. If you are not able to respect other’s views whether if agree with it or not, means either you have lost a lot in the market or ready to lose handsome in the future….Market is the biggest discipline machine. Mr. Brahmesh has been consistently showing us path of discipline trading… Just look at your life, see what are the areas you can improve inorder to become successful rather than pointing at others. Be like a swan, drink the milk and leave the water.

Krishna, Sir have his own trading strategy, and he is giving so much of his analysis data freely, please never argue and waste his time, if he don’t post any data you will understand sir importance.

please see tata motor chart , you will understand the game

Sree krishna, please stop argue . Bramesh doing excellent work & that is also free. Reality each market & stock have its own game.

please correct_ Fii’s added 10562 index future shorts yesterday ( mentioned in your note that they liquidated short index future to the extent of 10562 contracts )

Its corrected.

Did you post after watching dowjones.. Just asking

If Indian market follow US market we would be near life highs not below 8000. Follow system not US or any other market

My question is not what indian markets follow.. Its what you followed before posting

Did I post gann date of 02 Dec after seeing US market in Weekly Analysis ? As its gann date am expecting big move. Try to concentrate on what you “will do” in market, instead of questioning others ?

Its was simple question u could have said yes or no instead of typing mahabarat

For people like you We need to type MAHABHART so as not to repeat it again.

RGds,

Bramesh

You are the only one… Who says world indicies are not important… What should i say… Ill leave it to your imagination

Please do not worry about me. As i told trader should trade as per their comfort zone. For me all these are noises which I always ignore.

Whole world reacts to us markets.. U are not living in isolation.. Bramesh ji

My Trading strategy is follow price and ignore all noises. If whole world follow US market why only US market near life highs and not other world market. As a trader try to trust your system and ignore all noises. This is “MY WAY” of trading and am comfortable with it.

Trading without general view is lame..

Sree Krishna ji,

I respect your views, everybody is entitled to have their views and trading style.

I think this site may not be the best place for a person with your views, why waste your time here ?

There are a lot of people including me who come here to read Bramesh’s views. Please respect that.

I will advise you to start your own blog and share your valuable views there. You’ll also learn what it takes to achieve people’s respect and attention.

Thanks All for valuable comments..Its keep me going..