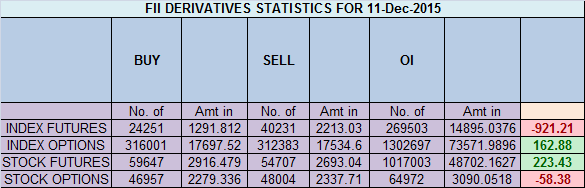

- FII’s sold 15.9 K contract of Index Future worth 922 cores ,8.1 K Long contract were liquidated by FII’s and 7.7 K short contracts were added by FII’s. Net Open Interest decreased by 398 contract, so today’s fall in market was used by FII’s to exit long and enter shorts in Index futures. Motivational Real Life Stories: The secret to keep winning in life!!!!

- As discussed yesterday Trend will change once we close above 7767, till than Nifty can go all the way down till 7539 and below. Nifty made high of 7703 and low 7575 near 7539 low. Many readers are confused on 2 harmonic analysis i have posted in past 2 session, Let me clarify so as not to confuse all, Harmonic Works on PRZ(Potential Reversal Zone) When we discussed Nifty forming Bullish SHARK pattern its PRZ is near 7550, so price action near 7539/7550 needs to be watched to check the validity of this pattern, On the Similar Ground we need to see ABCD pattern also whose formation will get confirmed if Nifty close below 7539 levels and Nifty might move towards 7237-7300 where PRZ lies for ABCD pattern.Bank Nifty forms bearish engulfing pattern,EOD Analysis

- Nifty December Future Open Interest Volume is at 1.94 core with addition of 5.7 Lakh with decrease in CoC suggesting long position were closed today. Nifty closing below rollover cost 7896.

- Total Future & Option trading volume was at 2.06 Lakh core with total contract traded at 1.5 lakh , PCR @0.77.

- 8000 CE OI at 67.4 lakh , wall of resistance @ 8000 .7600/8000 CE added 20 lakh in OI as bears added position at higher level most of addition was seen in 7600/7700 CE.FII bought 6.3 K CE longs and 8.4 K CE were shorted by them .Retail bought 43.3 K CE contracts and 15.9 K CE were shorted by them.

- 7500 PE OI@ 59.7 lakhs strong base @ 7500. 7600/8000 PE liquidated 4.9 lakh so bulls running for cover .FII bought 7.4 K PE longs and 1.7 K PE were by shorted them .Retail sold 10.5 K PE contracts and 7.4 K PE were shorted by them.

- FII’s bought 254 cores in Equity and DII’s bought 293 cores in cash segment.INR closed at 66.88.

- Nifty Futures Trend Deciding level is 7643 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7843 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7611 Tgt 7630,7660 and 7690 (Nifty Spot Levels)

Sell below 7575 Tgt 7554,7500 and 7450 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

what is CoC? i am sorry to ask this question but could not get answer either on this blog or internet. Kindly explain,

Please read this

http://www.brameshtechanalysis.com/2013/01/understanding-cost-of-carry-for-nifty-and-stock-futures/

Brahmesh ji, can you please elaborate on significance of 7767. Sorry if I missed any previously.

Please read this analysis http://www.brameshtechanalysis.com/2015/12/nifty-forms-inside-day-hammer-pattern/

FII bought 254 crs in equity market I think, not sold. Plz check.