- FII’s bought 7.4 K contract of Index Future worth 215 cores,39.4 K Long contract were added by FII’s and 32 K short contracts were added by FII’s. Net Open Interest increased by 71 K contract. Things You Should do Before Trading for A Living

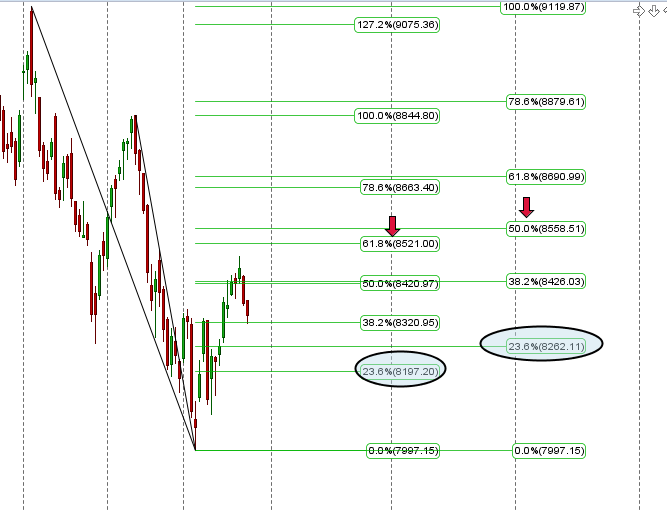

- Nifty reacted from the zone of resistance as shown in below chart, heading towards 20 SMA and Prices are heading towards the support zone of 8295-8356. Break below the same we can see deeper cut in market. As per Fibo Fans prices are again below 38.2 % retracement and unable to cross today’s high we can see expiry below 8200 odd levels. Below 8320 Fibo Retracement are at 8262/8197 levels. and Also Gunner is near cruciak 1*1 gann line and break of same can also bring momentum for bears. Volatile times ahead.

- Nifty May Future Open Interest Volume is at 1.19 core with liquidation of 9.5 lakh, just 6.8 lakh added in June Series, so traders are liquidating positions and rollovers stands at just 20% at price of 8450. Nifty future roll cost traded at ~55-56 points (adjusted for dividend of 35 points expected in June) for most part of the day. 83.9 K contracts were rolled; 37 K contracts were unwound in the near month. With NF trading in discount, a good proportion of open interest in Nifty futures is positioned towards reverse arbitrage positions (buy Nifty futures and sell constituents in cash). FII’s would prefer to roll over the long Nifty futures at lower level Hence they would prefer to roll at relatively low levels from the current one.

- Total Future & Option trading volume was at 3.02 core with total contract traded at 3.5 lakh. PCR @0.90

- 8500 CE OI at 58.4 lakh , wall of resistance @ 8500 .8100/8400 CE saw added of 5.4 lakh ,so bears added and still holding 65 lakh open position. FII bought 40 K CE longs and 25.6 K CE were shorted by them.Retailers bought 0.87 Lakh of CE longs.

- 8300 PE OI@ 49.4 lakhs so strong base @ 8300. 8300/8600 PE liquidated 14 lakh so bulls are got shock and panicked in just 150 point fall and liquidated 52 lakh position in 2 trading session suggesting base is not strong and break of 8300 can lead to sharp panic in market. FII sold 20 K PE longs and 4.8 K PE were shorted by them.

- FII’s bought 115 cores in Equity and DII’s bought 123 cores in cash segment.INR closed at 63.98

- Nifty Futures Trend Deciding level is 8338 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8294 and BNF Trend Deciding Level 18249 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18211 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8346 Tgt 8372,8404 and 8431 (Nifty Spot Levels)

Sell below 8312 Tgt 8287,8255 and 8212 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir,

While I could see the date of your posts, I could not see the time stamp…whether it was released before/during or after market hours. can u please explain me, as to how to know that.

Please like our FB page https://www.facebook.com/pages/Brameshs-Tech/140117182685863

It gets updated as soon as the site is updated.

this is yestday,s post…just the headinf changed….plz post todays nifty analysis sir

Please check the date. I did not update today post

Sir ,i have always seen in your blogs this comment on retail traders not to get in options ,do you mean they should only try cash and /or futures then. Also,if they do options with day trading time windows,does it make sense then or still not advised

Options are not meant for trading till you understand the instrument.

IV’s Gama Beta Theta so many terms need to be learn before trading in options.

Will nifty break the 200 DMA down words with a big bang fall or will take strong support around it in June series & reverse it’s direction. Ur valuable comments expecting.

Please check my today post for the answer.

Hi Bramesh JI I want to know after today’s EOD FII jun series F&O data is it possible

and how to trade today’s gap down opening below 8250 can go with CE8200?

Retail traders should not trade in OPtions.