- FII’s sold 9 K contract of Index Future worth 197 cores,34.3 K Long contract were added by FII’s and 43.3 K short contracts were added by FII’s. Net Open Interest increased by 77.7 K contract.Losing in Trading? Stick to a Trading Plan & Study Your Mistakes

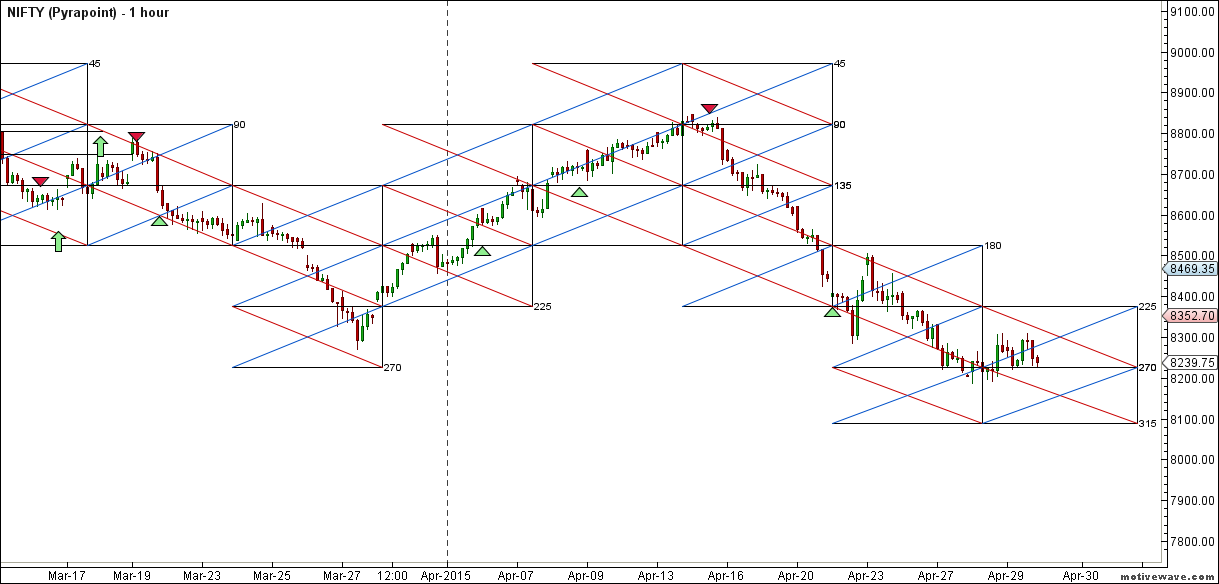

- Nifty formed an inside day pattern today trading well between yesterday High and low , but closing below 200 DMA and taking suspense of next big move on expiry day. Bulls have in favor nifty on daily chart took support at median line of Andrew Pitchfork also unable to make lower low, Also took support near 270 degree line of Pyrapoint line, As per Gunner also took support near the green channel as shown in below charts, suggesting the selling momentum is fading. Bears have in their favour is Nifty unable to make higher high and close below 200 DMA. Expiry can make or break the market as disappointment from US fed with break of 8185 can lead to huge unwinding of position and market can see a downmove till 8114/8085 odd levels. Higher side close above 220 degree line @8375 will change the trend to bullish. We have trading Holiday on Friday so tomorrow is last trading day for the week.

- Nifty April Future Open Interest Volume is at 1.10 core with liquidation of 31 lakhs with cost of carry going negative suggesting long position got closed.Rollover has started and we are seeing 52% rollover around 8300 in market till date.

- Total Future & Option trading volume was at 4.63 core with total contract traded at 6.4 lakh. PCR @0.88

- 8400 CE OI at 46.6 lakh , wall of resistance @ 8400 .8200/8400 CE saw addition of 16.4 lakhs ,so bears added fresh position also holding on to majority of positions. FII bought 26.1 K CE longs and 22.2 K CE were shorted by them.

- 8200 PE OI@ 57 lakhs so strong base @ 8200. 8400/8600 PE liquidated 4.8 lakh so bulls are stuck with panic still no addition seen in PE . FII sold 55 K PE longs and 8.8 K PE were shorted by them.

- FII’s sold 718 cores in Equity and DII’s bought 912 cores in cash segment.INR closed at 63.3.

- Nifty Futures Trend Deciding level is 8261(For Intraday Traders). NF Trend Changer Level (Positional Traders) 8310 and BNF Trend Deciding Level 18311 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18428 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8256 Tgt 8280,8300 and 8344 (Nifty Spot Levels)

Sell below 8219 Tgt 8200,8169 and 8114(Nifty Spot Levels)

Upper End of Expiry:8328

Lower End of Expiry:8151

Click Here to Like Facebook Page get Real time updates

Sir, I have been reading your articles.They are very well not only regarding trading but also regarding psychology of trading. You are making great help for all traders at free of cost. We all are thankful to you.

no levels=no trade .preserve capital. another day will come. good advice bramesh ji.tx

Bramesh Bhai, After a good Gap down, in first 15 minutes itself 2 sell targets crossed. In this scenario we still have to wait for the sell signal which was sell below 8219 or take a trade near 8169-70.

Thanks n regards,

no levels = no trade . Market will not end today preserve capital for next opportunity.

@reena: u seems to b new in trading , kindly keep a screenshot of ur comment ,and refer it after one year ,ul surely feel d immaturity in it. No offence ,just my view !

sir..ur trading ideas are great..i am learning lot of ideas from ur blog..if u give share ideas or give ur ideas about any query regarding some stocks, answering some question for some stocks, hope ur blog will be the most liked one of the world..

I know but i need to clarify my students doubt first, and its takes away most of time.

Rgds,

Bramesh

“Anything can happpen”

Sir u give position trade to both ways…..why?up trend and downside too as u r also not sure which way nifty is head ing for!!

As a trader you need to be prepared for uncertainty. My trading style do not let me make biased views. I enter market with open mind and ready to trade which side the price moves based on my trading system.

Its “MY” way of trading and if it does not suit your trading style please ignore my view and analysis.

Rgds,

Bramesh

Good reply from fan.. You should never have a biased opinion as markets are supreme.. Go with the trend as trend is friend..

no body … absolutely NO BODY knows which way market will move after 30 mins …. so only fools will take directional calls without waiting for any cues from market …

None can predict the market so accurately, if can he would be the billionaire, at least reasonable accuracy is good enough to make good money.I thinks you should first go through the fundamentals. This is a just suggestion. No offense.