- FII’s sold 2.6 K contract of Index Future worth 28 cores, 2.2 K Long contract were added by FII’s and 4.9 K short contracts were added by FII’s. Net Open Interest increased by 7.1 K contract ,so FII’s added majority shorts in Index futures in volumes trade today.

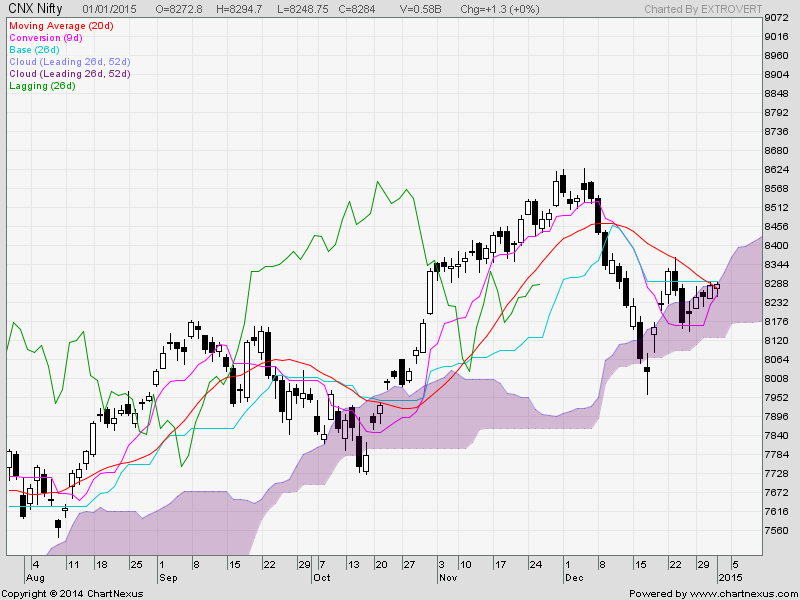

- Nifty is near very crucial point as per Ichimoku Cloud and big move is round the corner. Also 20/50 SMA are converging any break above 8310 can see explosive move on upside and break of 8214 can see move below 8174/8120. Nifty has closed above its 20 DMA after 18 sessions so positive signal for bulls but need a follow up tomorrow.

- Nifty Future Jan Open Interest Volume is at 2.11 core with liquidation of 0.28 lakh in OI. Volumes are quiet low as most of big traders are on Holiday so expect volumes after 05 Jan.

- Total Future & Option trading volume was at 0.58 lakh core with total contract traded at 1.5 lakh. PCR @0.99.

- 8400 CE OI at 38.1 lakh so wall of resistance @ 8400.8500/8700 CE saw no major addition of 6 lakhs low volumes trades in Nifty. FII bought 10.2 K CE and 12.9 K CE were shorted by them.

- 8200 PE OI@ 47.3 lakhs so strong base @ 8200. 8300 PE added 0.94 lakh in OI so big test of 8300 PE writers in next few days, if held we can see explosive move on upside. FII bought 35.9 K PE and 10.6 K PE PE were shorted by them.

- FII’s bought 18 cores in Equity and DII bought 19 cores in cash segment.INR closed at 63.39

- Nifty Futures Trend Deciding level is 8327 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8311 and BNF Trend Deciding Level 18865 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18794 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8301 Tgt 8319,8348 and 8364 (Nifty Spot Levels)

Sell below 8270 Tgt 8254,8226 and 8206 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Good one Bramesh