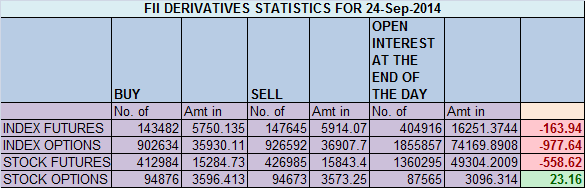

- FII’s sold 4.1 K contract of Index Future worth 164 cores, 5.1 K Long contract were added and 9.2 K short contracts were added by FII’s. Net Open Interest increased by14.4 K contract , so FII added longs in Index futures also shorts were added almost in 1:1.8 ratio.

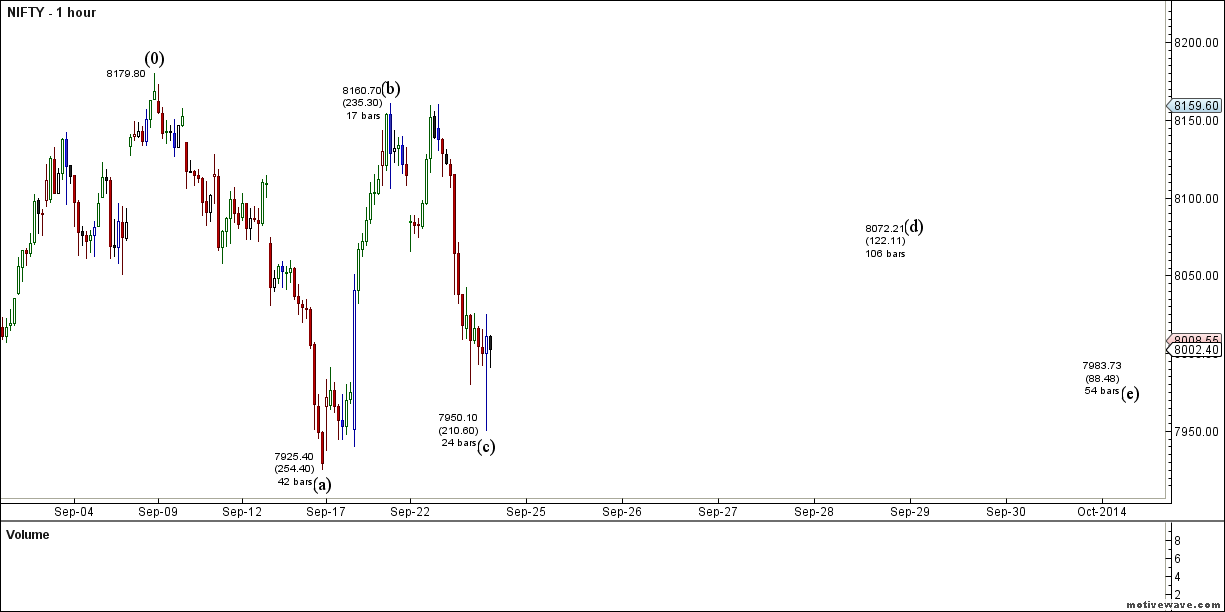

- This is what we discussed yesterday we are nearing trendline support, we can see intraday break of trendline till 7963/7930 but might close above this. So we did a panic low of 7950 on coal block case and bounced back sharply to close above 8000. As per EW we can now move to 8072 odd levels. Nifty held on to its trendline and today we can see a follow upmove. Nifty is trading in sideways mode of 7950-8160 and this rangebound trading can go on till bias change from neutral to bullish as discussed in weekly analysis. Bias is new concept we are developing to understand the future move on market.

- Nifty Future Sep Open Interest Volume is at 80 lakh with liquidation of 20 lakh which completely got rollovered to October series.

- Total Future & Option trading volume was at 4 lakh core with total contract traded at 2.7 lakh. PCR @0.95.

- 8200 CE OI at 74.3 lakh suggesting wall of resistance , 8100 CE added 11.6 lakh suggesting expiry should be around 8100, 8000 CE also added 18.4 lakh so 8000 can hold today and expiry can be near 8050/8100. FII’s sold 2.6 K CE longs and 13.2 K CE were shorted by them.

- 8000 PE OI@ 66.4 lakhs so base @ 8000 is getting jittery . 8100 PE OI@21.6 lakh so 8100 will not be crossed till expiry now looking at liquidation, FII’s bought 9.5 K contract PE longs and17.6 K PE contract were shorted by them mostly in 8000/7900 PE.

- FII’s sold 793 cores in Equity and DII sold 15 cores in cash segment.INR closed at 60.96.

- Nifty Futures Trend Deciding level is 8013 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8090 and BNF Trend Changer Level (Positional Traders) 16098.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8010 Tgt 8024,8074 and 8100 (Nifty Spot Levels)

Sell below 8000 Tgt 7965, 7930 and 7910 (Nifty Spot Levels)

Expiry Range: 8050-7950

Click Here to Like Facebook Page get Real time updates

Excellent prediction and Nifty stopped exactly 1 point above what you have said in the morning ( 7910) . Thank you.

Thanks Sir and happy navratri to u n family.

Thanks a lot Wishing you and your family the same !!

Gud Morning Sir,

Do the concepts of price and OI action hold good in options as well ?

i.e

1) Increase in price with increase in open interest :Fresh buying

2) Increase in price with decrease in open interest : short covering : Contacts which were written earlier are being bought back.

3) Decrease in price with increase in open interest : Fresh selling

4) Decrease in price with decrease in open interest : Long unwinding : contracts which were bought earlier are being sold

Hv a great trading day,

Vineet

Yes sir Holds well !!

Dear Bramesh Sir,

I was waiting for your daily posts till now and I am not able to see that; I hope you have not posted daily analysis for the day.