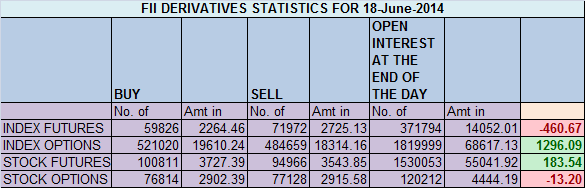

- FII’s sold 12.1 K contract of Index Future worth 460 cores, 2.7 K Long contract were added and 14.9 K short contracts were added So FII’s went aggressively short in index futures.My observation is – Institutions short – Big Bears Short – Market Falls – Big Bears Cover – Pigs Short -Institutions Cover – Market Rallies for the Pigs to get slaughtered.

- Nifty has been sideways mode from past 10 trading session frustrating traders, On 06 June Nifty closed at 7583 and today it closed at 7540 so just a move of 40 points from past 10 trading session on closing basis, Sentiments in these 10 days went from Extreme Bullishness to Extreme Bearish with nifty showing volatile moves within range of 7700-7480.As shown in below chart, 7500-7520 range has been absorbing lot of selling pressure, once if it gets broken we can see a quick downfall towards 7470-7450 range.Also Gann chart shows Nifty not able to sustain above green line can see a fall till Blue line. Weekly closing tommrow Bulls will like to protect 7550 and bears would like to close below 7422.

- Nifty Future May Open Interest Volume is at 1.42 cores with addition of of 0.8 lakhs in Open Interest, showed addition of short positions.

- Total Future & Option trading volume at 2.41 lakh core with total contract traded at 2.8 lakh.PCR @0.92, fall was backed by volumes.

- 7600 Nifty CE is having highest OI at 68.4 lakhs and 7700 CE having second highest OI suggesting 7600 will not be an easy hurdle to cross.16.8 lakh addition in 7600 and 7700 suggests that bears are back with bang and eying lower levels. FII’s bought 13.1 K CE longs and 18 K CE were shorted by them.

- 7500 PE OI at 51.1 lakh saw liquidation of 2.3 lakh so support of 7500 looks dicey now, 7300 PE also liquidated 3.2 lakhs suggesting smart sellers are booking profit an early indication 7500 can break .FII’s bought 33.9 K PE longs and 7.3 K shorted PE were covered by them.FII’s are still aggressive buyers in Put options suggesting we are not out of woods still so cautious on long.

- FIIs sold 420 cores in Equity and DII sold 117 cores in cash segment.INR closed at 60.10.

- Nifty Futures Trend Deciding level is 7566 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7513 and BNF Trend Changer Level (Positional Traders) 15288 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7550 Tgt 7570,7600 and 7640 (Nifty Spot Levels)

Sell below 7493 Tgt 7474, 7442 and 7400 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Please send me all course details with venue, mode of training(online/offline), charge and total timing at my email.

It just depends at the end in which side u end at

“Pigs Short – Institutions cover – market rallies for the pigs to be slaghtered” wah wah kya line hai…. will remember this for a long time…………

Bhai one serious question, based on this data tomorrow I take shorts based on our system, so am I the one who is “behti ganga mein mein dhora” or the PIGS???

Thanks a lot