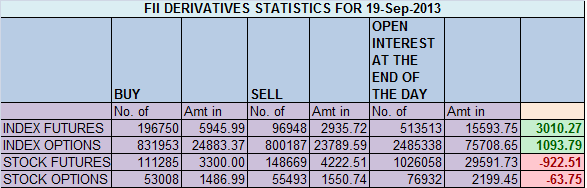

- FIIs bought 99802 contracts of Index Future (bought 80352 long contract and 19450 shorts were squared off) worth 3010 cores with net Open Interest increasing by 60902 contracts.So Fed kept the money flowing to India and FII have again been a net Buyers in Index Futures.

- Nifty in past 6 days was trading and consolidating above 200 DMA, and opened with big gap of 200 points, Many were surprised by the move and ferocity of the move but readers of the blog would have enjoyed the rally, We have discussed September is Bullish month for Indian markets, In Nifty Weekly Analysis clearly mentioned till it trades above Weekly Trend Deciding level its Bullish which was 5806, Be it Nifty Chopad, Price Action all were bullish now what can stop a trader being long is market is its “EGO”, Thinking market has run to much to fast so lets short it. Market never love indiscipline and the day you did trader need to pay a price. Today we have the RBI policy and Nifty is also approaching the higher end of Fibo Fan and range of 6207-6234 will act a tough resistance to cross. On Downside Any close below 6077 will only be bearish for short term.

- Nifty Future Sep Open Interest Volume is at 1.62 cores with addition of 5.4 lakhs in Open Interest,with reduction in cost of carry highest in Sep series. Nifty rallied almost 214 points but OI rose by only 5.4 lakhs, so traders are still not participating in the rally.

- Total Future & Option trading volume at 2.22 lakh with total contract traded at 3.97 lakh Cash volume is highest ever huge delivery based buying ,PCR (Put to Call Ratio) has moved above 1.13, VIX at last has the fall of 11%

- 6200 Nifty CE is having highest OI at 41.4 lakhs with addition of 5.4 lakhs in OI will be short term resistance. 5800-6100 CE liquidated huge 44 lakh in OI bears caught on wrong foot and were all running for cover.As per FII analysis 32.6K long were added Calls, 4.1 K calls were shorted mostly in 6200 CE. 5700-6300 CE liquidated 23 lakh in OI.

- 6000PE is having the highest OI of 41.9 lakhs, suggesting strong support of Nifty.6100 PE added 28.6 lakh in OI suggesting FII has taken exposure in Buying 6100 PE so a pullback till 6100 can be seen today. As per FII data 20.9 contract of PE mostly in 6100 PE were added and 25.9 fresh PE were shorted mostly in 6000 PE.More PE writing suggests bulls are on firm ground.5500-6000 PE added huge 54 lakh in OI.

- FIIs bought in Equity in tune of 3543 cores ,and DII sold 1829 cores in cash segment.INR closed at 61.5 so our analysis of Indian Rupee heading for 61-62 levels,Weekly Analysis

- Nifty Futures Trend Deciding level is 6119 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 5713 and BNF Trend Changer Level (Positional Traders) 9832 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 6143 Tgt 6171,6207 and 6234(Nifty Spot Levels)

Sell below 6099 Tgt 6077, 6040 and 6000 (Nifty Spot Levels)

Live Nifty A/D charts Click on the Link

Traders who use Pivot and Camarilla can use the following 2 sites for Hourly values and EOD values

http://camarillapivotpoints.blogspot.com/

http://niftystockpivot.blogspot.in/

You can LIKE Facebook page by clicking on the below link and get timely update.http://www.facebook.com/pages/Brameshs-Tech/140117182685863